Depreciation: our top tip for tax deductions for property investors

As a property investor you already know the tax benefits of property investing. But are you giving yourself the best opportunity to lower your taxable income by maximising your tax deductions?

Understand your tax entitlements for a positive cash flow by using our list of top 10 tax deductions as your go-to for tax time. Look out for our bonus tip!

-

Loan Interest

An investor may claim the interest charged on a loan for their investment property and any bank fees for servicing the loan. The property must be leased or genuinely available for rent. For example; you borrow $350,000 to buy an investment property. The interest incurred over the financial year was $35,000 and the loan service fee was $200.00. You can claim $35,200 on your personal tax return.

-

Agent Fees.

Do you use an agent to collect your rent, find tenants and maintain your rental?

Yes? Then you can claim any fees or commissions you have paid to an agent.

-

Garden Maintenance.

Maintaining a garden, including replacement of plants and garden structures is a claimable expense. However, you can’t claim the cost of anything new that will add value to the property as this is deemed as an improvement and would be depreciated accordingly.

-

Rental Advertising Costs.

Do you advertise your property for lease via online advertising, print media, signs or brochures? Claim the advertising expenses against your income within the same year that you paid for it.

-

Insurance.

Claim the yearly cost of insuring your rental property against your income.

-

Council Rates.

Investors can claim Council Rates the year that they were paid. However, rates can only be claimed during the time the property was rented. For example, your property was only rented for 200 days out of the year, so you can only claim 54.79% of the rates (200/365 = 54.79%)

-

Pest Control.

If you have ordered pest control as the landlord on your investment property, you can claim the tax deduction for the cost of hiring a professional pest control company.

-

Strata Fees.

Claim the cost of body corporate fees if your investment property is on a strata title. NOTE, if your strata fees include maintenance and garden expenses, you can not claim these expenses separately.

-

Bookkeeping Costs.

Do you get confused over tax preparation of your investment property? Hire a professional accountant that specialises in property investment. You can claim the cost of advice, preparation of tax returns and any expense incurred for management of your rental accounts – remember, you can only claim within the same year the costs were incurred.

-

Building Repairs & Maintenance.

Claim building repairs if they relate directly to wear and tear. For example, roof tiles needed replacing after a storm, you can claim for the professional hired to replace the tiles. This is different to replacing an appliance, which would become part of the depreciation schedule over the lifespan of the asset. Same goes for installing new fixtures or carpets for example; this would be considered as adding value to the property and you would claim this as a capital works deduction.

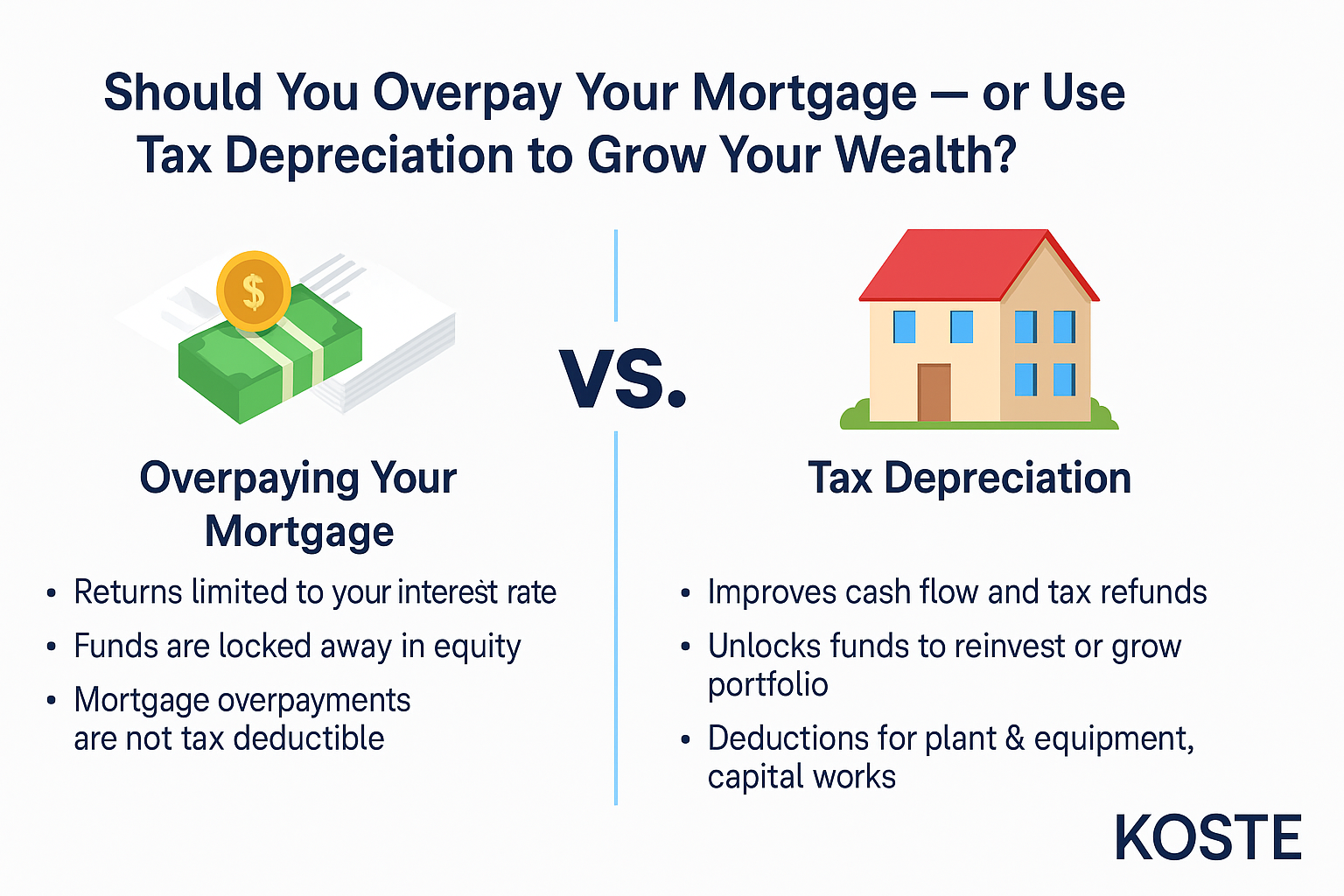

OUR TOP TIP – DEPRECIATION

Did you know up to 80% of investors have never initiated a Depreciation Schedule of their property? If you are one of the 80%, you’re missing out on the 2nd highest tax deduction after interest on your loan! Wowzers!

So What is a Depreciation Schedule and Why should I buy one?

A depreciation schedule is a report which will detail the value of your building, structure and fixtures over a period of time, usually 40 years. This schedule is used yearly at tax time when your accountant completes your tax return.

If you’re a property investor, we highly recommend you engage a Quantity Surveyor to

complete a Depreciation Schedule of your property.

Quantity Surveyors are professionals recognised by the ATO who prepare schedules to the exact requirements and standards set by the ATO. You could try to do the schedule yourself, but there’s many pitfalls you may not be aware of. The cost of hiring a Quantity Surveyor for your depreciation schedule is a once off fee and can be claimed at tax time.

The advantages of having a depreciation schedule include:

Significantly reduce your taxable income by thousands of dollars each year and have your property return positive cash flow; the schedule is tailored to maximise ALL of the benefits available to you under Australian law;

Want to know how much tax you can save on your investment property? Koste offer a FREE estimate on your depreciation entitlement. Give us a call and our team will provide you with a review.

Related Tag: Tax Depreciation Australia

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.