ATO’s 2024 Crackdown: Essential Insights for Property Investors

The Australian Taxation Office (ATO) is intensifying its efforts to ensure compliance among property investors in 2024. With enhanced data-matching capabilities and a focus on accurate reporting, it’s crucial for investors to stay informed and meticulous in their tax documentation. Here’s what you need to know:

Enhanced Data-Matching Capabilities

The ATO has significantly expanded its data sources to include information from property managers, landlord insurance providers, and financial institutions providing investment loans. This expansion allows the ATO to cross-check rental income and expense claims more effectively. Notably, they have introduced new protocols to monitor investment loan data and landlord insurance policy information.

Common Reporting Errors

Property investors frequently make mistakes in their tax returns, which can lead to significant penalties. The ATO has identified several common errors, including:

- Incorrect Apportionment of Loan Interest: Many investors claim interest on loans used for personal purposes, such as holidays or car purchases. It’s essential to only claim interest related to income-generating properties.

- Misclassifying Capital Improvements as Repairs: Costs for substantial improvements should be capitalised rather than claimed as immediate repairs.

- Insurance Premiums and Payouts: While insurance premiums for rental properties can be claimed as deductions, any payouts must be reported as income.

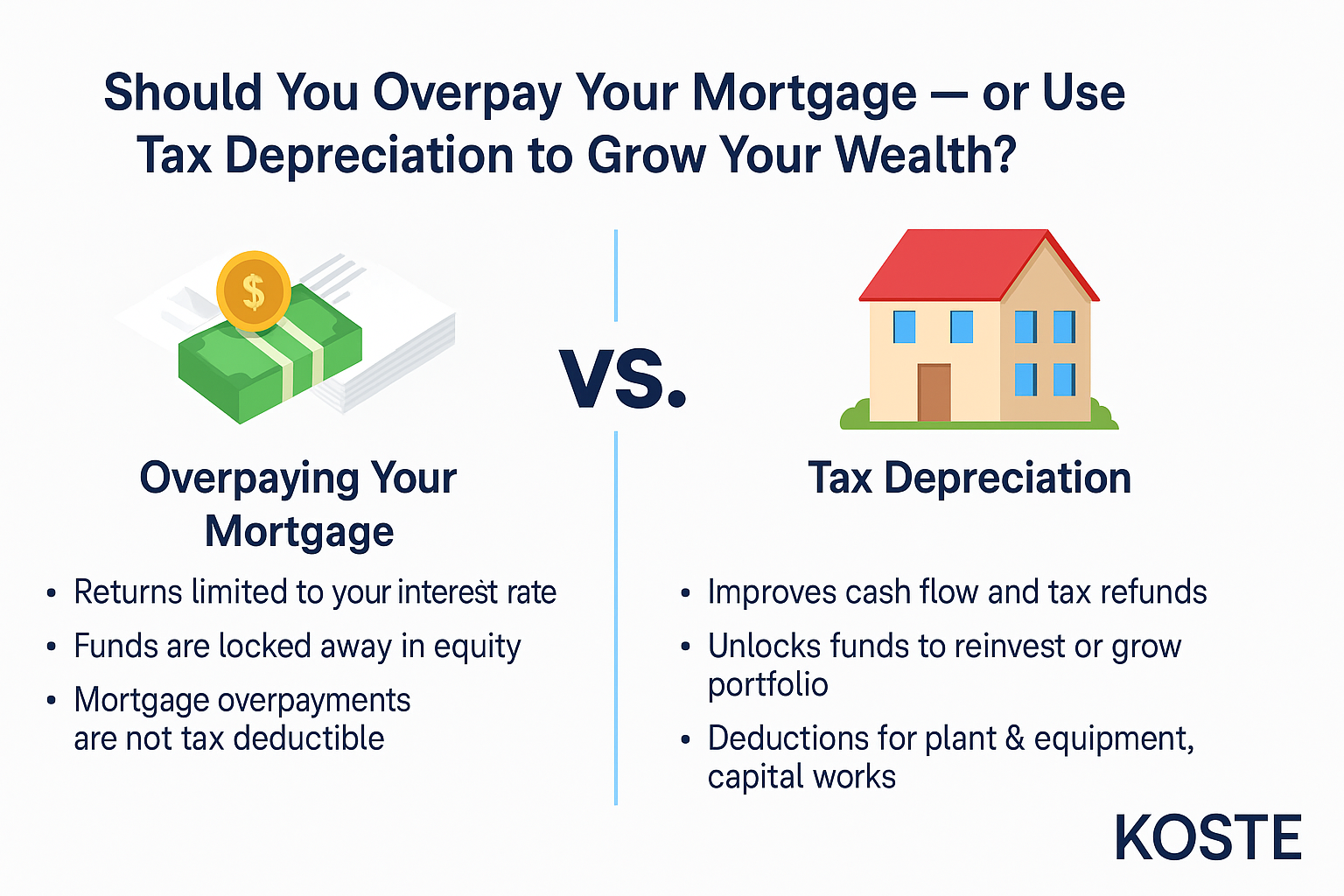

Errors in Tax Depreciation Schedules

Tax depreciation is a powerful tool for property investors, offering substantial deductions on eligible assets. However, errors in depreciation schedules can lead to complications:

- Incorrect Asset Classification: Misclassifying assets can result in incorrect depreciation rates being applied.

- Omitting Eligible Assets: Failing to include all eligible assets in the schedule can lead to missed deductions.

- Incorrect Effective Lives: Using incorrect effective lives for assets can either accelerate or delay deductions improperly.

- Neglecting to Update Schedules: Not updating schedules after significant changes to the property or tax laws can lead to inaccuracies.

Capital vs. Repairs: Understanding the Difference

Understanding the distinction between capital improvements and repairs is essential for accurate tax reporting:

- Capital Improvements: These are substantial changes or additions that enhance the property’s value, such as adding a new room or installing a new roof. Capital improvements must be depreciated over time.

- Repairs: These are maintenance activities that keep the property in its current condition, such as fixing a leaky tap or repainting walls. Repairs can typically be deducted immediately.

In-Depth Audits

This year, the ATO plans to conduct 4,500 detailed audits focusing on over-claimed mortgage interest and under-reported rental income, particularly from short-term rental platforms like Airbnb. With these targeted audits, it’s vital to ensure that all claims are accurate and well-documented.

Importance of Accurate Records

Given the increased scrutiny, maintaining precise records has never been more critical. Property investors should keep detailed documentation of all income and expenses, ensuring they can substantiate every claim. This includes:

- Loan Agreements: Clear records of loan purposes and interest payments.

- Receipts and Invoices: For all repairs, improvements, and other deductible expenses.

- Insurance Documents: Details of premiums paid and any payouts received.

Maximising Deductions and Supporting Your Claims

Educating property investors on maximising their deductions while ensuring they can support every claim is essential. This means understanding the intricacies of tax laws and keeping comprehensive records. By doing so, investors can significantly reduce their taxable income, keeping more money in their pockets rather than paying it to the government for use on various projects.

Tax Depreciation: Support When You Need It

Tax depreciation is a powerful tool for property investors, offering substantial deductions. However, navigating the complexities of depreciation schedules requires expertise. Partnering with a reputable company like Koste Chartered Quantity Surveyors can provide invaluable support. With comprehensive knowledge of tax laws and meticulous attention to detail, Koste ensures that your claims are accurate and maximised. Moreover, in the event of an audit, having a professional team behind you can make a significant difference in managing the process smoothly.

Take Action Now

The ATO’s enhanced focus on property investors underscores the importance of proactive and accurate tax management. Ensure your records are in order and consider engaging experts to support your tax depreciation claims. By staying informed and prepared, you can confidently navigate the 2024 tax season.

#TaxTips #PropertyInvesting #ATOUpdates #TaxDepreciation #PropertyManagement

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.