How does Depreciation Management assist hotel businesses?

Many commercial properties or business owners are unaware of the Depreciation benefits until they have spoken with Koste.

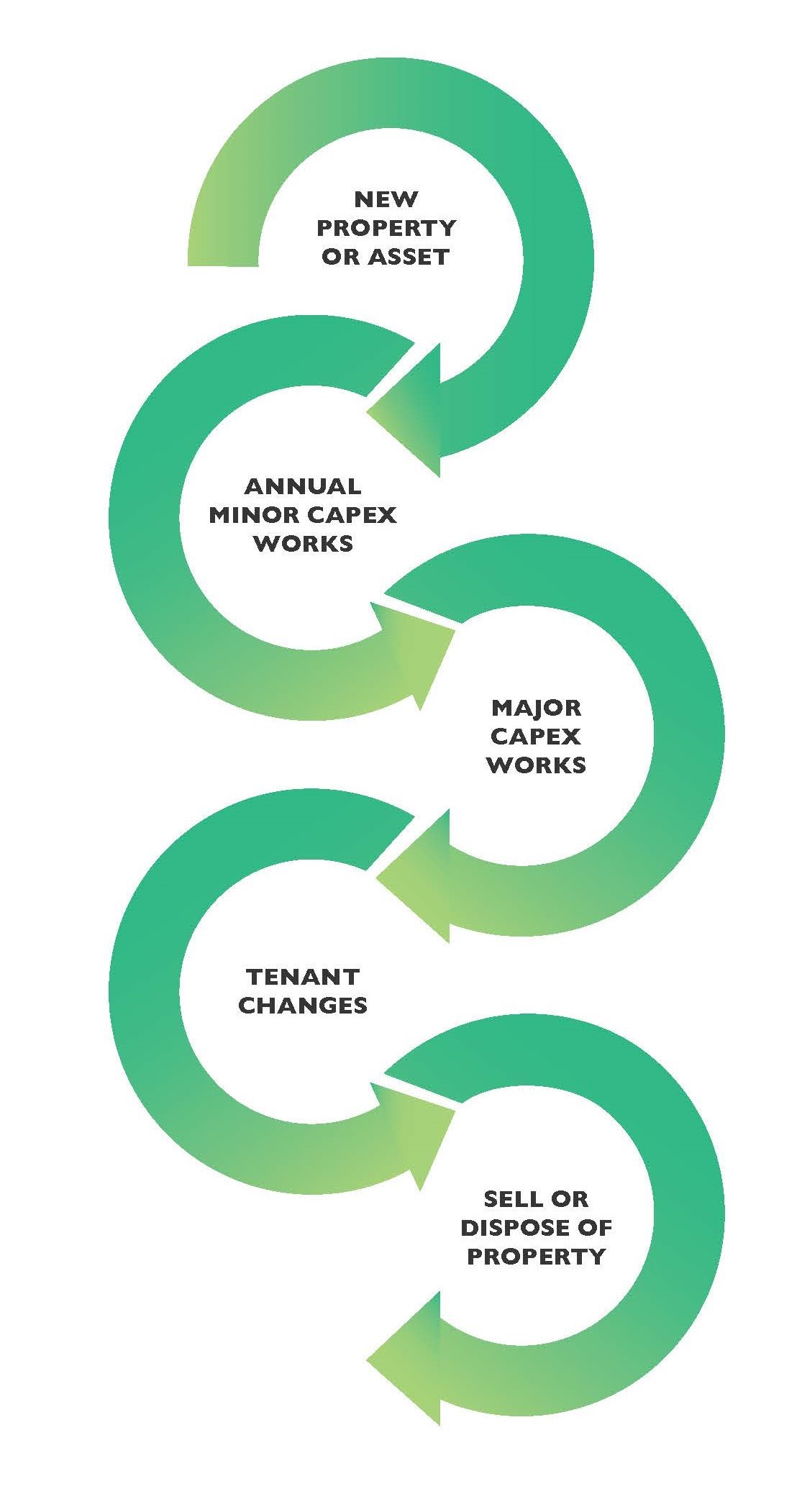

Koste has developed CODE (Creating Optimum Depreciation Entitlements) reporting to assist commercial property owners with the management of Tax Depreciation through regular updates. Depreciation management is a ongoing process starting right from the moment when property or business owner acquire the commercial property or business. Most businesses are missing out on billions of unclaimed Tax Depreciation entitlements annually from the ATO.

DEPRECIATION SCHEDULE

A detailed depreciation schedule is completed

– Full Survey carried out

– Establish building cost base

– Data provided in Excel sheet

– ATO compliant reports

ASSET REGISTER

An asset register is a detailed asset schedule used for a variety of uses. Asset details include location, model numbers and asset codes.

ANNUAL CAPEX UPDATES

Koste provides a service to maintain your tax depreciation schedules on an annual basis.

BALANCING ADJUSTMENT

Claim a Balancing adjustment if assets have been disposed of, demolished, or removed.

– Claim capital and plant assets

– Claim in the year of demolition

– Written down value used

TENANT ABANDONMENT

In some assets that your tenant has left there, the fit-outs could.

– Claim on capital work items

– Establish a cost base for capital work items to depreciate

How do hotel clients benefit from Tax Depreciation and Depreciation Management?

Hotel clients can claim for the building portion which can be accelerated to 4% over 2.5% for residential property. Koste also assists the clients to claim for all the division 40 items and plant & equipment that are associated with the building, which increases their returns as they depreciate at higher rates compared to the building. For a hotel, we also look after the loose furniture and equipment that are used in the hotel rooms.

How does Koste provide an asset register for the hotel clients?

Koste creates an asset register of the building by listing the assets according to their locations and sub-locations. This helps with locating certain items that may have been removed. Basically, it is a list of all the items in the property that can be searched through by its locations. We are also able to depreciate the items individually, which increases the depreciation deductions, as by treating them individually items can drop into the low value pooling sooner.

How often do hotel clients need to conduct an asset register?

Under Depreciation Management, the asset register only needs to be done once at the beginning of ownership and then maintained annually.

What is an annual CAPEX update? How does it related to hotel clients?

An annual CAPEX (short for capital expenditure) update, is for expenditure done annually or quarterly, or even monthly, where Koste analyzes this expenditure and depreciates it accordingly. Hotels are constantly doing expenditure on new furniture, maintaining assets, or renovating, so Quantity Surveyors will need to update the Depreciation Schedule to reflect this expenditure.

How will hotel clients benefit from balancing adjustment?

A balancing adjustment can be claimed for items disposed of and also for renovations where part of the building may have been demolished. In other words, this increases the returns as the remaining value of the item can be written off in the year of disposal.

Related Tag: Depreciation on Residential Building

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.