How Insurance Proceeds Impact Depreciation – A Comprehensive Guide

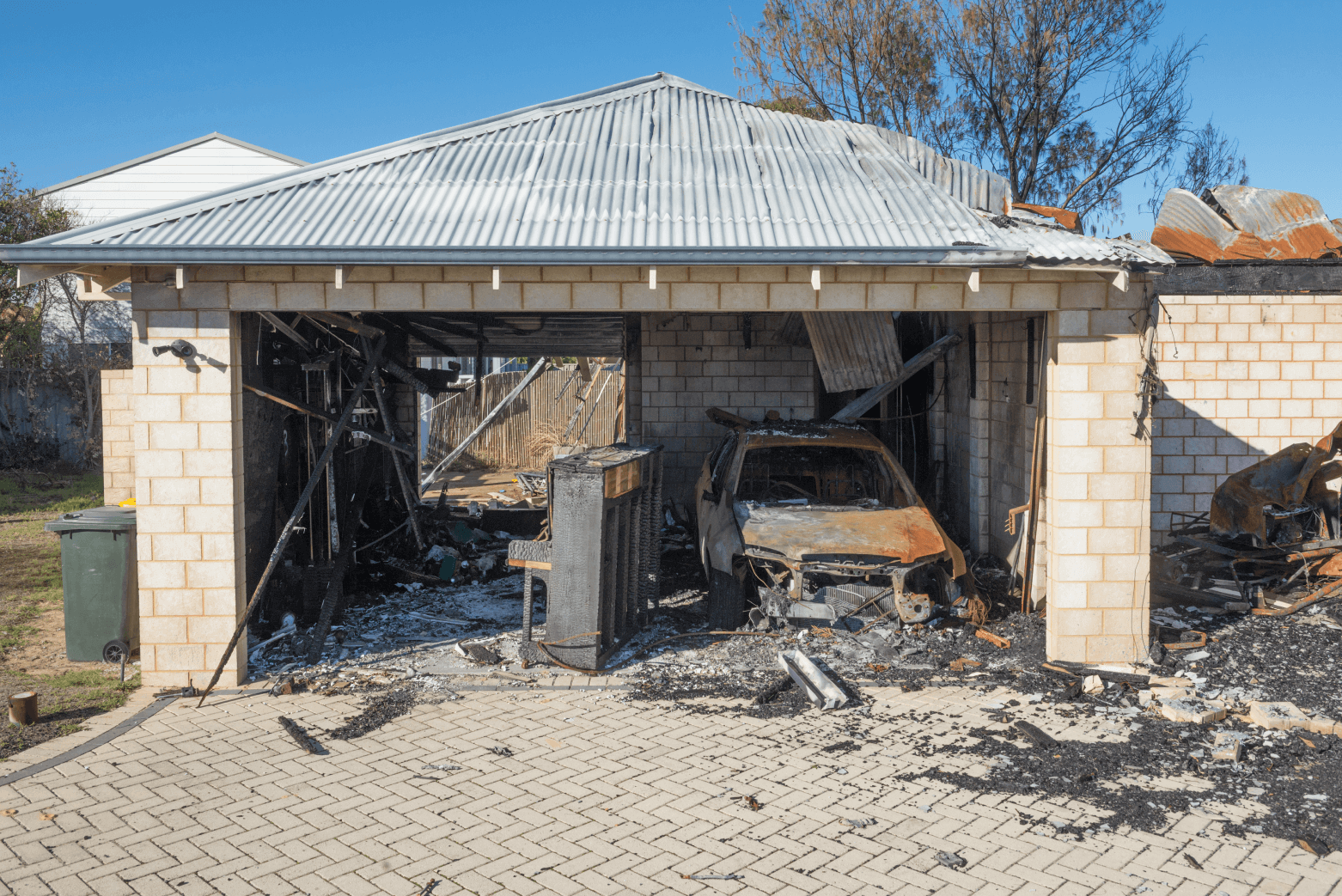

At Koste Chartered Quantity Surveyors, we specialise in helping a wide range of clients, from large corporations to individual investors, navigate the complex world of tax depreciation. When it comes to properties damaged by fire, floods, or other events, insurance proceeds play a critical role in determining what can be claimed in terms of tax depreciation.

This guide breaks down three key scenarios—whether the insurance company replaces assets, provides a cash payout, or the property owner contributes additional funds—and provides real-world examples for clarity.

Section 1: Insurance Company Replaces Assets Directly

When an insurance company covers the cost of replacing assets or repairing a property, the tax treatment for depreciation is straightforward:

Key Tax Rules:

- No depreciation on insurance-funded replacements: The property owner cannot claim depreciation on any new assets or repairs funded by the insurance company, as the owner did not incur these costs.

- Scrapping deduction: If assets are destroyed and replaced, the owner can claim a scrapping deduction for the remaining written-down value of those assets that were being depreciated before the damage.

| Scenario | Tax Treatment |

|---|---|

| Insurance-funded replacements | No depreciation on insurance-funded assets |

| Destroyed assets (e.g., plant & equipment) | Claim a scrapping deduction for the remaining undepreciated value. |

Example 1:

An investor owns a rental property with a kitchen valued at $15,000, which was destroyed in a fire. The kitchen had a remaining depreciation value of $4,000. The insurance company replaces the kitchen with a brand-new one at no cost to the owner.

- Outcome: The owner can claim a scrapping deduction of $4,000 but cannot claim depreciation on the new kitchen since the insurance company covered the cost.

Section 2: Insurance Company Provides a Cash Payout

When an insurance company provides a cash payout instead of directly replacing the damaged assets, the property owner has control over how the funds are used. However, the tax implications can differ based on how the payout is applied.

Key Tax Rules:

- Depreciation on owner-funded repairs: If the property owner uses the payout to cover repairs or a rebuild, they can claim depreciation on any portion of the costs they incur directly.

- Scrapping deduction: If the insurance payout exceeds the cost of the repairs or rebuild, the excess may be subject to Capital Gains Tax (CGT). Rollover relief under Section 124-85 of ITAA 1997 may allow the owner to defer CGT if the payout is reinvested into the property.

| Scenario | Tax Treatment |

|---|---|

| Owner uses payout for repairs/rebuild | Depreciation can be claimed on any owner-funded repairs or rebuild costs. |

| Excess payout (payout exceeds rebuild cost) | The excess may trigger CGT, unless rollover relief applies. |

| Payout is less than remaining depreciation value | The difference can be claimed as a scrapping deduction. |

Example 2:

A client receives an insurance payout of $120,000 after their rental property suffers water damage. The actual cost of repairs is $100,000, so the client uses the remaining $20,000 to upgrade the kitchen.

- Outcome: The client can claim depreciation on the $20,000 spent upgrading the kitchen (as it is owner-funded). However, the remaining $100,000 used to repair the property cannot be depreciated since it was funded by the insurance payout.

Section 3: Owner Adds Extra Funds to the Insurance Payout

In some cases, the property owner may decide to contribute additional funds beyond the insurance payout to upgrade or extend the property. This scenario allows for potential depreciation opportunities on the owner-funded portion.

Key Tax Rules:

- Depreciation on owner-funded improvements: If the owner contributes extra funds to improve or upgrade the property, these expenses can be depreciated under Division 43 over 40 years for capital works or under Division 40 for plant and equipment

- No depreciation on insurance-funded portions: As in previous scenarios, depreciation cannot be claimed on any portion of the repairs or rebuilds that were covered by the insurance payout.

| Scenario | Tax Treatment |

|---|---|

| Owner contributes extra funds for improvements | Depreciation can be claimed on owner-funded improvements or upgrades. |

| Insurance-funded portion | No depreciation on insurance-funded repairs or rebuilds. |

Example 3:

A property owner receives a $150,000 insurance payout to repair damage caused by a storm. The owner decides to add $50,000 of their own funds to upgrade the property with an additional bedroom.

- Outcome:The owner can depreciate the $50,000 spent on the additional bedroom as capital works under Division 43. The $150,000 funded by the insurance cannot be depreciated.

Section 4: Encouraging Clients to Seek Expert Advice

At Koste Chartered Quantity Surveyors, we specialise in navigating the complex tax implications around insurance claims and tax depreciation. Our experience advising both large corporate clients and mum and dad investors means that we understand the nuances of each case and can tailor solutions to maximise tax savings.

We strongly encourage our partners and clients to reach out to our team when dealing with situations involving insurance payouts and depreciation. These scenarios can be complex, and we can help ensure that opportunities for tax savings are not overlooked. By challenging assumptions and thoroughly analysing the specifics of each case, we help our clients make the most of their tax depreciation claims.

Key Considerations for Accountants:

- Scrapping deductions: Ensure that scrapping deductions are claimed for the undepreciated value of destroyed assets.

- Depreciation on new assets: Only claim depreciation for expenses directly incurred by the owner.

- Capital Gains Tax (CGT): Consider CGT if insurance payouts exceed repair costs, and explore rollover relief options.

- Document everything: Proper documentation of repair, rebuild, and improvement costs is essential for accurate tax treatment.

| Scenario | Tax Treatment |

|---|---|

| Owner contributes extra funds for improvements | Depreciation can be claimed on owner-funded improvements or upgrades. |

| Insurance-funded portion | No depreciation on insurance-funded repairs or rebuilds. |

Conclusion

Understanding how insurance proceeds impact depreciation is crucial for accountants advising property investors. Whether the insurance company directly replaces the assets, provides a cash payout, or the owner contributes additional funds, the tax treatment for depreciation must be carefully managed.

At Koste Chartered Quantity Surveyors, we are experts in tax depreciation, and we encourage our clients to engage with us to challenge complex scenarios and ensure optimal tax outcomes. By leveraging our expertise, clients can maximise their tax deductions and remain compliant with ATO regulations.

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.