How to Maximise Tax Depreciation

What to look for in a Tax Depreciation Report

When you or your client purchases or constructs a property, you may be advised to obtain a Tax Depreciation Report to help you save income tax. Although you may have some knowledge why you have to get a report, you may not know how to select a provider.

The initial Tax Depreciation report you get should be completed by a Quantity Surveyor, and will vary from supplier to supplier. You will often find that reports costing as little as $195 will often miss significant deductions and will not be compliant if an ATO audit ever occurs.

Here are our top 10 requirements you should look for In a Tax Depreciation Provider

1) Site Inspection

Koste provides clients with 3 x different package options to suit all budgets and requirements. Not all reports benefit from a site inspection, especially with May 9th legislation changes which limits Div 40 deductions. Where no site inspection is required, we will pass on any saving to our clients. For our site inspection packages including Gold and Platinum we complete inspections through vKoste (Virtaully) and Physical inspections. Our detailed site inspection has been developed over a number of years and involves the surveyor going into every room of the property whether virtually or physically, making a list of all the depreciable assets and takign photographic evidence.

2) Is Your Quantity Surveyor is Qualified

There are 100s of providers claiming to be Qualified Quantity Surveyors specialising in Tax Depreciation, however very few are full members of professional organisations. Koste are full regulated members of the Royal Insitute of Chartered Surveyors (RICS) and are full corporate members of the Corporate Australian Institute of Quantity Surveyors (AIQS) (Please note: Any company which is advertsing themselves as an Affiliate AIQS Grade member is not a full professional member)

3) Common Areas / Strata Inclusion

Many property investors will have purchased an investment property in a complex which has Common Areas (Shared Facilities). You will generally be part of a strata and have an allocated unit entitlement based on a percentage of the value of the whole development. Common area deductions can be significant, especially where you have large expensive plant items such as lifts, fire services and leisure facilities.

4) Furniture Inclusions

With increased popularity of Airbnb many property investors are now choosing to furnish properties to help achieve higher rental yields. Any expense incurred for furniture should be included in your depreciation schedule. The important aspect of depreciating furniture is manage effectly, ensure you add items to the schedule and writeoff when disposed of.

5) Post Build Improvement Works

When you purchase a secondhand property, it may have had improvments completed after the the original construction date. It takes a skilled Quantity Surveyor to establish the value of the additional improvments often providing significant additional deductions. We have found that the majority of secondhand properties have had improvement works completed. This may include improvements such as a new kitchen, bathroom, swimming pool or even painting)

6) Low Value Pooling

Low Value Pooling has been around since 1st July 2000 for non small business taxpayers and can be used based on the Income Tax Act 1997 Subdivision 40-E. The Low Value Pool includes assets which have a total cost less than $1,000 which can depreciated at an accelerated rate. Using Low Value Pooling does not suit everyone, and shoudl be discussed with a qualified accountant. Koste provides detailed report utilising this to maximise tax depreciation deductions.

7) Immediate Writeoffs

Koste utilises the Immediate deduction allowance on assets with a value less than $300 that are not in a pair. These assets can be claimed 100% in the first year of your Tax Depreciation schedule. Their are however rules and a test behind claiming this deduction. The main test which moste asset fails on is defined by the ATO as “the asset isn’t one of a number of identical or substantially identical assets you start to hold in the income year that together costs more than $300”

8) Structural Works

Under Div 43 Capital Works, the depreciation rate of 2.5% was introduced on the 27th February 1992 for Structural Works. Often missed, is the additional deductions which could be claimed for external assets which fall under the category of Structural Works. Swimming Pools, Fencing, Hard Landscaping, Driveways and Pergolas are all eligible for depreciation deductions. These items can add significant deductions which should not be missed.

9) Based on Apportionment of Purchase Price

Tax Depreciation should be calculated based on the proportion of the purchase price which relates to the plant and equipment, building and land. Legislation states that this must be a reasonable apportionment however does not stipulate the method of calculating this in legislation. Koste are one of the very few Quantity Surveyors who utilise this method to apportion Tax Depreciation and achieve significantly higher deductions than our competitors. (a 100m2 unit in Sydney bought for $900k will not have the same depreciation value as a unit in Wollongong bought for $500k) If you would like to learn mosre about our methods please give us a call.

10) Managing Depreciation

It is important that your Tax Depreciation provider is with you throughout your property ownership. There is a saying “Out with the old, in with the new.” Assets and improvments will inevitably need updating as the property is getting older. As new assets are replaced or installed, the depreciation schedule should be updated. The old assets removed may have a written down which needs to be claimed for. If you are planning to make improvments to a property ensure they offer this unique service as this could be very benefical in years to come.

Compliance and Risk

Whilst maximising Tax Depreciation deductions is an important factor to consider, the company you engage also needs to be compliant with the current Tax legislation and that they will minimise any risk of and ATO Audit.

1) Qualified Quantity Surveyor

Ensure your Quantity Surveyor is Fully Qualified. The majority of Tax Depreciation companies are operating under an Affiliate grade membership of the AIQS. (Please note: Any company which is advertsing themselves as an Affiliate AIQS Grade member is not a full professional member) Koste are full regulated members of the Royal Insitute of Chartered Surveyors (RICS) and are full corporate members of the Corporate Australian Institute of Quantity Surveyors (AIQS)

2) Registered Tax Agents

Search the Tax Practitioners Board (TPB) for a clean ompany record with no Suspensions, Disqualifications or sanctions.

3) Company History

With the recent property boom, many companies are setting up businesses claiming to be Tax Depreciation Specialists. We would encourage you to search the company through ASIC to establish the length of time they have been operating. We would advise to look for a company who has been operating for at least 5 years.

4) Guarantee

Koste is confident with providing clients with a full money back guarantee. In addition to this we offer clients a guarantee of 3 x our fee in the first 12 months of depreciation deductions.

5) Past Experience

The Koste Group has been operating since 2004 and have completed in excess of 50,000+ residential reports and are advisors to major organisations. Its Directors have more than 20+ years of specialist Tax Depreciation Experience and are Full memberss of the AIQS and RICS holding the professional nominals MRICS and MAIQS

6) Realistic Figures

We have seen such differences in the rates and methods used to calculate depreciation. As professionals we need to provide accurate cost information and not rely on published cost data as outlined in Tax Legislation. Koste work to maximise returns whilst keeping within the boundarys of the current tax legislation

In accordance with the current legislation (Tax Ruling 97/25), The Australian Tax Office (ATO) recognises Qualified Quantity Surveyors as suitable professionals who are able to calculate asset values including building costs used for Tax Depreciation Schedules.

With 100s of suppliers completing Tax Depreciation Schedules, you need to take care when selecting a provider to limit the risk of an ATO review and audit which nobody would want. We are always reviewing competitors works, and often worried about clients who are using incorrect figures not knowingly.

Koste has a detailed process to ensure all reports are quality assured with maximum returns achieved whilst limiting any risk. We would recommend the following points to ensure you are choosing a Quantity Surveyor who is suitably experienced to complete your report:

Related Tags: Tax Depreciation Australia, Depreciation Schedule Australia

Unsure what you need?

Other people viewing…

Koste Awarded Highly Commended – Quantity Surveying Team of the Year

RICS Awards 2025, Melbourne We are proud to announce that Koste Chartered Quantity Surveyors has been recognised as Highly Commended – Quantity Surveying Team of the Year at the RICS Australia Awards 2025, held in Melbourne. This recognition represents one of the...

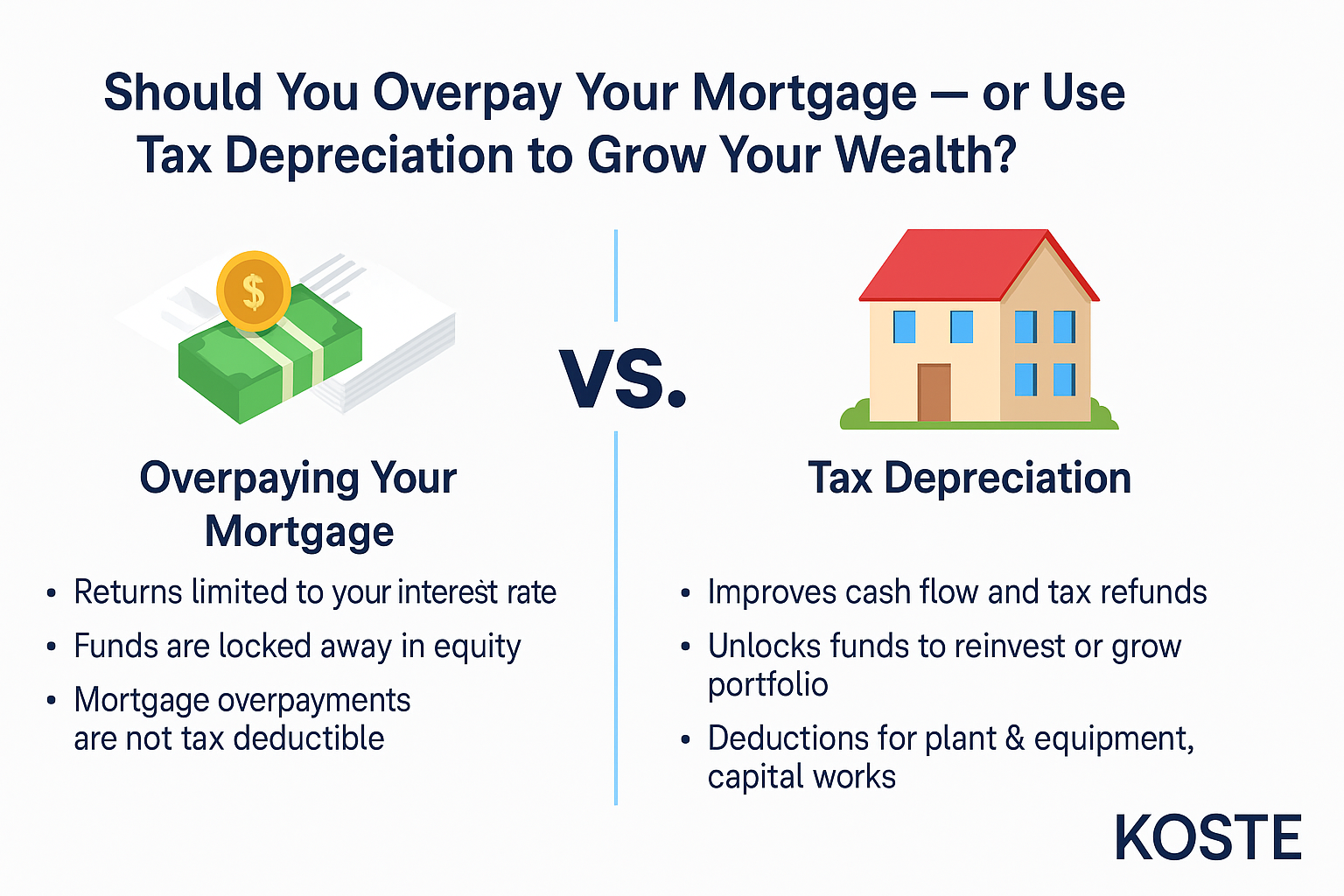

🏠 Should You Overpay Your Mortgage — or Use Tax Depreciation to Grow Your Wealth?

Here’s a bold truth: Overpaying your mortgage won’t make you wealthy — but reinvesting tax savings might. With Australia’s property market seeing significant capital growth in recent years, the smartest investors aren’t pouring every spare dollar into debt reduction....

How Mum-and-Dad Investors Can Help Solve Australia’s Housing Crisis

Australia is facing a housing shortage of 1.5 million homes, and the rising costs of construction and labour, alongside regulatory delays, are stalling new developments. However, mum-and-dad investors—who own 72% of Australia’s investment properties—could be the key...

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.