Brisbane Unit – 1 bed 1 bath

South Brisbane QLD 4101

Tax Depreciation

T.D559,663 over 40 years

$645,000

Learn More

Thornlands Shopping Centre QLD

Thornlands QLD 4164

Shops & Retail

T.D$424,197 over 40 years

$1,925,000

Learn More

Kings Meadows TAS-4 Beds 2 Bath

Kings Meadows TAS 7249

Tax Depreciation

T.D$599,576 over 40 years

$579,767

Learn More

Maroochydore QLD- 4 Beds 3 Bath

Maroochydore QLD 4558

Tax Depreciation

T.D$283,436 over 37 years

$685,000

Learn More

Baldivis WA- 3 Beds 2 Bath

Baldivis WA 6171

Tax Depreciation

T.D$99,318 over 30 years

$358,200

Learn More

Brassall Bakery Shop QLD

Brassall QLD 4305

Shops & Retail

T.D$125,900 over 40 years

$120,000

Learn More

Burleigh Heads Factory Warehouse QLD

Burleigh Heads QLD 4220

Factory, Warehouse & Industrial

T.D$361,228 over 40 years

$745,000

Learn More

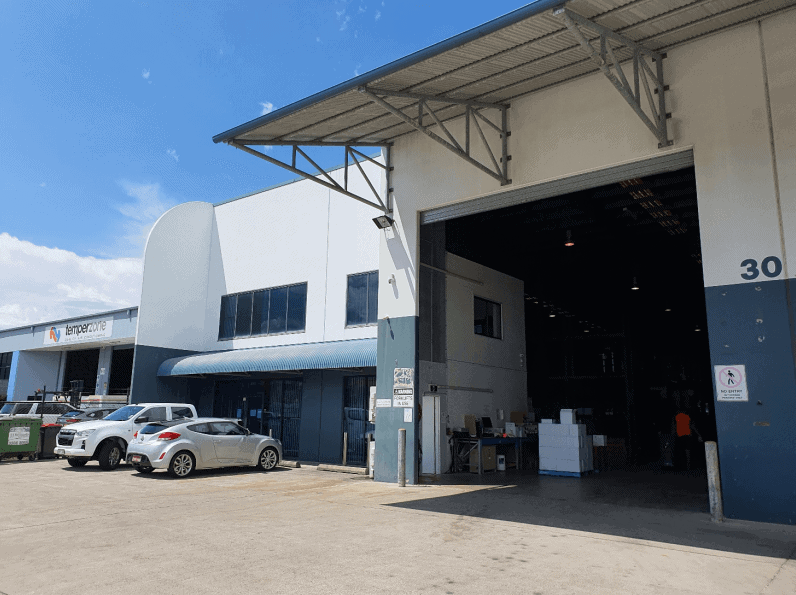

Yatala Factory Warehouse QLD

Yatala QLD 4207

Warehouse, Factory & Industrial • Offices

T.D$1,448,276 over 40 years

$1,475,000

Learn More

St Lucia QLD- 2 Beds 2 Bath

St Lucia QLD 4067

Tax Depreciation

T.D$60,226 over 40 years

$455,000

Learn More

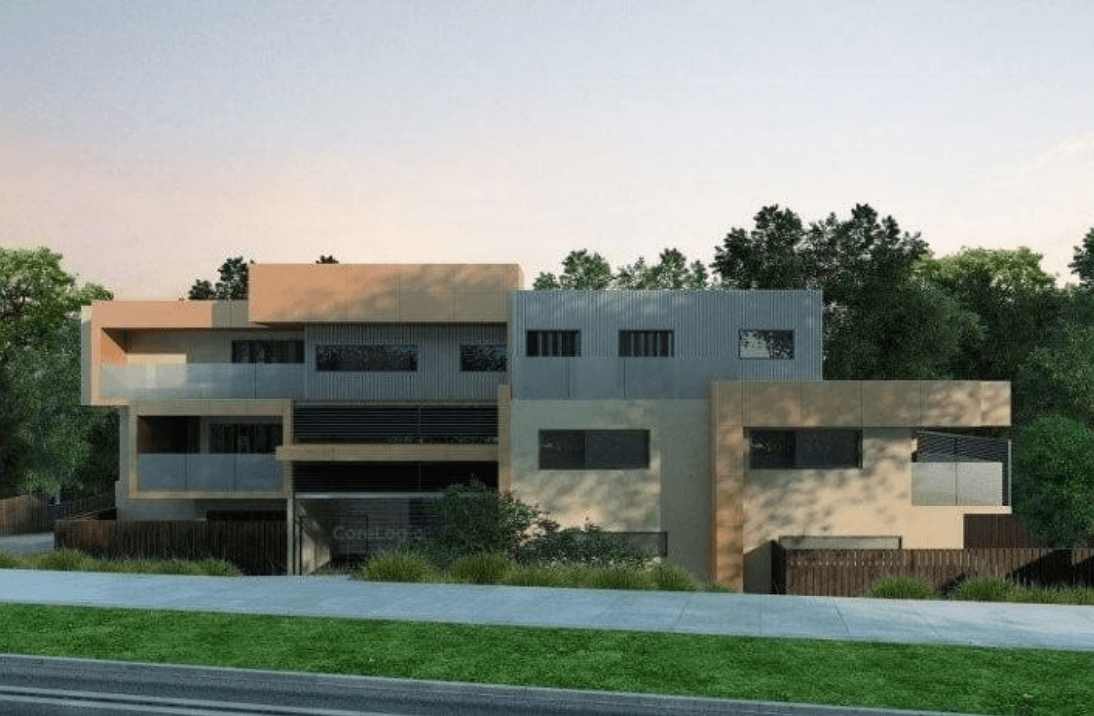

Macleod VIC- 3 Beds 2 Bath

Macleod VIC 3085

Tax Depreciation

T.D$158,543 over 40 years

$868,000

Learn More

Hope Island QLD- 5 Beds 4 Bath

Hope Island QLD 4212

Tax Depreciation

T.D$448,515 over 39 years

$2,165,000

Learn More

Malvern East VIC- 4 Beds 2 Bath

Malvern East VIC 3145

Tax Depreciation

T.D$65,690 over 40 years

$1,900,000

Learn More

Wattle Grove WA- 3 Beds 2 Bath

Wattle Grove WA 6107

Tax Depreciation

T.D$640,000

$173,196 over 30 years

Learn More

Maroochydore QLD- 2 Beds 2 Bath

Maroochydore QLD 4558

Tax Depreciation

T.D$373,872 over 40 years

$675,000

Learn More

Eight Mile Plains QLD- 4 Beds 1 Bath

Eight Mile Plains QLD 4113

Tax Depreciation

T.D$581,235 over 40 years

$630,000

Learn More

Ellenbrook WA- 3 Beds 2 Bath

Ellenbrook WA 6069

Tax Depreciation

T.D$141,134 over 35 years

$439,221

Learn More

Melton South VIC- 4 Beds 2

Melton South VIC 3338

Tax Depreciation

T.D$216,106 over 40 years

$219,097

Learn More

Brinsmead QLD- 4 Beds 2 Bath

Brinsmead QLD 4870

Tax Depreciation

T.D$85,414 over 40 years

$555,000

Learn More

Greenway ACT- 2 Beds 2 Bath

Greenway ACT 2900

Tax Depreciation

T.D$378,371 over 40 years

$474,000

Learn More

Redland Bay QLD- 3 Beds 2 Bath

Redland Bay Qld 4165

Tax Depreciation

T.D$172,992 over 40 years

$173,500

Learn More

Caringbah Small Storage NSW

Caringbah NSW 2229

Factory, Warehouse & Industrial

T.D$46,817 over 40 years

$175,000

Learn More

Southport Facefit Skincare Clinic QLD

Southport QLD 4215

Personal Care Services

T.D$253,277 over 40 years

$253,277

Learn More

Salisbury Factory Warehouse QLD

Salisbury QLD 4107

Factory, Warehouse & Industrial

T.D$512,885 over 40 years

$1,062,000

Learn More

Mount Barker SA- 4 Beds 2 Bath

Mount Barker SA 5251

Tax Depreciation

T.D$270,910 over 40 years

$495,000

Learn More

Surfers Paradise Boulevard QLD- 2 Beds 1 Bath

Surfers Paradise QLD 4217

Tax Depreciation

T.D$41,054 over 39 years

$335,000

Learn More

Kingston ACT- 2 Beds 1 Bath

Kingston ACT 2604

Tax Depreciation

T.D$236,080 over 40 years

$480,000

Learn More

Collingwood VIC- 1 Bed 1 Bath

Collingwood Vic 3066

Tax Depreciation

T.D$54,388 over

$520,000 over 26 years

Learn More

Port Macquarie NSW- 2 Beds 2 Bath

Port Macquarie NSW 2444

Tax Depreciation

T.D$348,515 over 40 years

$1,000,000

Learn More

West End QLD- 2 Beds 2 Bath

West End Qld 4101

Tax Depreciation

T.D$324,853 over 40 years

$496,335

Learn More

Broadbeach QLD- 2 Beds 2 Bath

Broadbeach QLD 4218

Tax Depreciation

T.D$189,498 over 40 years

$890,000

Learn More

Sunnybank Hills QLD- 3 Beds 2 Bath

Sunnybank Hills Qld 4109

Tax Depreciation

T.D$186,131 over 4 years

$1,175,000

Learn More

Paddington QLD- 3 Beds 1 Bath

Paddington QLD 4064

Tax Depreciation

T.D$32,017 over 24 years

$1,119,500

Learn More

Surfers Paradise QLD- 3 Beds 2 Bath

Surfers Paradise QLD 4217

Tax Depreciation

T.D$676,213 over 40 years

$1,050,000

Learn More

Glenside SA- 2 Beds 1 Bath

Glenside SA 5065

Tax Depreciation

T.D$43,207 over 40 years

$740,000

Learn More

Oaklands Park SA- 3 Beds 1 Bath

Oaklands Park SA 5046

Tax Depreciation

T.D$123,636 over 31 years

$405,000

Learn More

St Johns Park NSW- 6 Beds 2 Bath

St Johns Park NSW 2176

Tax Depreciation

T.D$176,268 over 36 years

$1,228,000

Learn More

Liverpool NSW- 2 Beds 2 Bath

Liverpool NSW 2170

Tax Depreciation

T.D$363,471 over 40 years

$564,000

Learn More

Rockhampton City QLD (Rooming House) 21 Beds 8 Baths

Rockhampton City QLD 4700

Tax Depreciation

T.D$557,902 over 40 years

$430,000

Learn More

Burleigh Heads Factory Warehouse QLD

Burleigh Heads QLD 4220

Factory, Warehouse & Industrial

T.D$82,399 over 29 years

$1,040,000

Learn More

Greenway ACT- 2 Beds 1 Bath

Greenway ACT 2900

Tax Depreciation

T.D$347,084 over 40 years

$429,000

Learn More

Helensvale QLD- 4 Beds 3 Bath

Helensvale QLD 4212

Tax Depreciation

T.D$608,691 over 37 years

$1,800,000

Learn More

Office Fit out Brisbane City QLD

Brisbane City QLD 4000

Office Fitout

T.D$1,500,774 over 40 years

$1,500,774

Learn More

Cincotta Discount Chemist Indooroopilly QLD

Indooroopilly QLD 4068

Pharmacy

T.D$1.220,014 over 40 years

$4,470,000

Learn More

Lennox Head Pharmacy NSW

Lennox Head NSW 2478

Pharmacy

T.D$645,124 over 40 years

$3,600,000

Learn More

Banksmeadow Office Fitout NSW

Banksmeadow NSW 2019

Office

T.D$100,085 over 40 years

$970,000

Learn More

North Manly NSW- 4 Bed 3 Bath

North Manly NSW 2100

Tax Depreciation

T.D$233,982 over 40 years

$1,740,000

Learn More

Box Hill VIC- 2 Beds 2 Bath

Box Hill VIC 3128

Tax Depreciation

T.D$606,903 over 40 years

$959,500

Learn More

Currumbin QLD- 2 Beds 2 Bath

Currumbin QLD 4223

Tax Depreciation

T.D$1,275,000

$65,597 over 40 years

Learn More

Brookdale WA- 4 Beds 2 Bath

Brookdale WA 6112

Tax Depreciation

T.D$33,287 over 40 years

$310,000

Learn More

Dayton WA- 3 Beds 2 Bath

Dayton WA 6055

Tax Depreciation

T.D$37,513 over 40 year

$433,000

Learn More

Baulkham Hills NSW- 4 Beds 2 Bath

Baulkham Hills NSW 2153

Tax Depreciation

T.D$46,602 over 40 years

$1,935,000

Learn More

Oasis Centre Slacks Creek QLD

Slacks Creek QLD

Shops & Retail

T.D$4,345,232 over 40 years

$9,300,000

Learn More

Noosaville Factory Warehouse QLD

Noosaville QLD

Factory Warehouse

T.D$217,698 over 40 years

$750,000

Learn More

Harrisdale WA- 4 Beds 2 Bath

Harrisdale WA

Tax Depreciation

T.D$55,676 over 40 years

$610,000

Learn More

Office Fitout Underwood QLD

Underwood QLD 4119

Office Fitout

T.D$907,113 over 40 years

$1,461,888

Learn More

Goonellabah NSW 2480

Goonellabah NSW 2480

Warehouse, Factory & Industrial • Offices

T.D$502,712

$935,000

Learn More

Greenslopes QLD – 2 bed 2 bath

Greenslopes QLD

Tax Depreciation

T.D$47,136 over 40 years

$518,000

Learn More

Industrial Warehouse Dandenong South VIC

Dandenong South VIC

Warehouse, Factory & Industrial

T.D$4,341,128 over 40 years

$28,090,909

Learn More

Industrial Warehouse Smithfield NSW

Smithfield NSW

Warehouse, Factory & Industrial

T.D$9,517,401 over 40 years

$9,517,401

Learn More

Kingsgrove Factory Warehouse NSW

Kingsgrove, NSW 2208

Factory, Warehouse & Industrial

T.D$3,901,786 over 40 Year

$37,000,000

Learn More

Prime Spec Warehouse QLD

Pinkenba QLD 4008

Warehouse, Factory & Industrial

T.D$6,190,440

$6,305,591

Learn More

Intergen Office Fitout QLD

Brisbane City QLD 4000

Office Fitout

T.D$1,517,177 over 40 Years

$1,517,177

Learn More

Contentrix Office Fitout QLD

Brisbane City QLD 4000

Office Fitout

T.D$8,757,084 over 40 Years

$8,757,084

Learn More

Stanwell Energy Office Fitout QLD

Brisbane City QLD 4000

Office Fitout

T.D$662,360 over 40 Years

$662,360

Learn More

Jemena Fitout VIC

Broadmeadows VIC 3047

Office Fitout

T.D$13,490,823 over 40 Years

$13,535,418

Learn More

Foster & Partners Unit NSW

Sydney NSW 2000

Office Fit Out

T.D$245,490 Over 40 Years

$245,490

Learn More

Office Fit Out Macquarie Park NSW

MACQUARIE PARK, NSW 2113

Office Fit Out

T.D$8,820,138 for 40 Years

$8,820,138

Learn More

Uniting Care FitOut QLD

Brisbane City QLD 4000

Uniting Care Office Fit Out

T.D$9,882,158

$9,882,158

Learn More

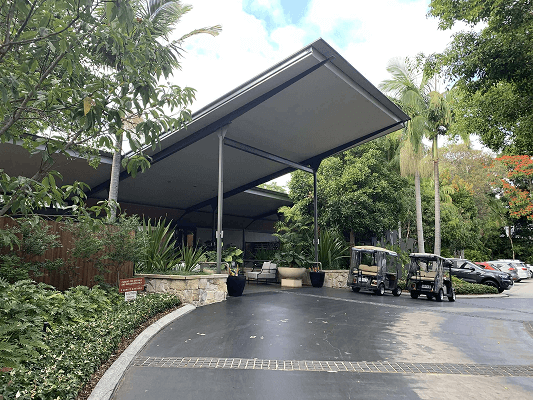

The Riley Hotel QLD

Cairns City QLD 4870

Hotel

T.D$136,947,826 Over 40 years

$141,012,434

Learn More

Carlton VIC – 3 Beds 2 Bath

Carlton VIC 3053

Tax Depreciation

T.D$269,075 over 40 years

$429,000

Learn More

Altona Meadows VIC – 1 Beds 1 Bath

Altona Meadows VIC 3028

Tax Depreciation

T.D$142,999 over 37 years

$530,000

Learn More

Oxley QLD – 3 Beds 2 Bath

Oxley QLD 4075

Tax Depreciation

T.D$295,966 over 40 years

$499,900

Learn More

Kellyville NSW – 5 Beds 3 Bath

Kellyville NSW 2155

Tax Depreciation

T.D$506,297 over 40 years

$462,837

Learn More

Upper Mount Gravatt QLD – 2 Beds 2 Bath

Upper Mount Gravatt QLD 4122

Tax Depreciation

T.D$200,334 over 35 years

$405,000

Learn More

Pomona QLD – 6 Beds 4 Bath

Pomona QLD 4568

Tax Depreciation

T.D$579,266 over 40 years

$1,665,000

Learn More

Shopping Centre Acacia Ridge QLD

Acacia Ridge QLD 4110

Shops & Retail

T.D$153,676 Over 40 years

$146,325

Learn More

Belmont QLD – 3 Beds 2 Bath

Belmont QLD 4153

Tax Depreciation

T.D$79,260 over 40 years

$545,000

Learn More

Coomera QLD – 4 Beds 2 Bath

Coomera QLD 4209

Tax Depreciation

T.D$214,398 over 40 years

$498,000

Learn More

Newtown QLD – 4 Beds 2 Bath

Newtown QLD 4350

Tax Depreciation

T.D$3,347 over 37 years

$250,000

Learn More

Kingscliff NSW – 2 Beds 2 Bath

Kingscliff NSW 2487

Tax Depreciation

T.D$264,426 over 40 years

$810,000

Learn More

Eastgardens NSW – 2 Beds 2 Bath

Eastgardens NSW 2036

Tax Depreciation

T.D$328,767 over 40 years

$850,000

Learn More

Broadbeach Waters QLD – 4 Beds 3 Bath

Broadbeach Waters QLD 4218

Tax Depreciation

T.D$313,255 over 39 years

$1,730,000

Learn More

Highgate SA – 5 Beds 2 Bath

Highgate SA 5063

Tax Depreciation

T.D$151,241 over 40 years

$1,280,000

Learn More

Strathfield NSW – 2 Beds 2 Bath

Strathfield NSW 2135

Tax Depreciation

T.D$71,467 over 35 years

$810,000

Learn More

Broadbeach Waters QLD – 4 Beds 4 Bath

Broadbeach Waters QLD 4218

Tax Depreciation

T.D$302,476 over 39 years

$1,485,000

Learn More

Carrara Office Warehouse QLD

Carrara QLD 4211

Warehouse, Factory & Industrial • Offices

T.D$368,011 Over 40 years

$757,100

Learn More

Altona Meadows Medical Center VIC

Altona Meadows VIC 3028

Medical & Consulting

T.D$281,202 Over 40 years

$987,525

Learn More

Epping Warehouse VIC

Epping VIC 3076

Warehouse, Factory & Industrial • Showrooms & Large Format Retail • Offices

T.D$313,022 Over 40 years

$605,000

Learn More

Truganina Warehouse VIC

Truganina VIC 3029

Factory, Warehouse & Industrial

T.D$238,408 Over 40 years

$363,586

Learn More

Childcare Center QLD

Manoora QLD 4870

Medical & Consulting

T.D$616,567 Over 40 years

$2,387,383

Learn More

Rasoi Indian Gourmet Store NSW

Orange NSW 2800

Shops & Retail

T.D$85,858 Over 34 years

$640,000

Learn More

West Croydon SA – 2 Beds 1 Bath

West Croydon SA 5008

Tax Depreciation

T.D$28,328 over 39 years

$300,000

Learn More

Semaphore South SA – 2 Beds 1 Bath

Semaphore South SA 5019

Tax Depreciation

T.D$27,449 over 40 years

$380,000

Learn More

Tonsley SA – 2 Beds 2 Bath

Tonsley SA 5042

Tax Depreciation

T.D$174,964 over 40 years

$369,000

Learn More

Sellicks Beach SA – 3 Beds 2 Bath

Sellicks Beach SA 5174

Tax Depreciation

T.D$200,830 over 36 years

$365,000

Learn More

Mowbray TAS – 2 Beds 1 Bath

Mowbray TAS 7248

Tax Depreciation

T.D$99,377 over 33 years

$325,000

Learn More

Rokeby TAS – 3 Beds 2 Bath

Rokeby TAS 7019

Tax Depreciation

T.D$201,940 over 39 years

$425,000

Learn More

Belmont WA – 2 Beds 2 Bath

Belmont WA 6104

Tax Depreciation

T.D$144,478 over 40 years

$340,000

Learn More

Maddington WA – 4 Beds 3 Bath

Maddington WA 6109

Tax Depreciation

T.D$77,545 over 40 years

$520,000

Learn More

Narre Warren South VIC – 4 Beds 2 Bath

Narre Warren South VIC 3805

Tax Depreciation

T.D$345,771 over 40 years

$350,000

Learn More

Cranbourne VIC – 3 Beds 1 Bath

Cranbourne VIC 3977

Tax Depreciation

T.D$37,634 over 40 years

$334,000

Learn More

Southport Office Warehouse QLD

Southport QLD 4215

Warehouse, Factory & Industrial • Offices

T.D$692,843 Over 40 years

$1,950,000

Learn More

West End Retail Shop QLD

West End QLD 4101

Shops & Retail

T.D$334,597 Over 40 years

$271,022

Learn More

Wellcamp Warehouse QLD

Wellcamp QLD 4350

Factory, Warehouse & Industrial

T.D$8,029,501 Over 40 years

$5,618,409

Learn More

Helensvale Pharmacy QLD

Helensvale QLD 4212

Pharmacy

T.D$9808,819 Over 40 years

$2,150,000

Learn More

Southport Park Pharmacy QLD

Southport QLD 4215

Pharmacy

T.D$977,954 Over 40 years

$4,100,000

Learn More

Klemzig Medical Center SA

Klemzig SA 5087

Medical & Consulting

T.D$9,440,110 Over 40 years

$8,886,499

Learn More

Fortitude Cres Warehouse QLD

Burleigh Heads QLD 4220

Warehouse, Factory & Industrial

T.D$299,257 Over 40 years

$2,500,001

Learn More

TerryWhite Chemmart Bundaberg Pharmacy QLD

Bundaberg Central QLD 4670

Pharmacy

T.D$198,282 Over 40 years

$1,065,000

Learn More

Dam Lawyers QLD

Forest Lake QLD 4078

Tax Depreciation

T.D$739,253 Over 37 years

$187,595 (Fir-Out)

Learn More

Tongue and Groove Hair and Beauty Retreat QLD

Brown Plains QLD 4118

Personal Care Services

T.D$96,720 Over 40 years

$500,000

Learn More

M Carvery – Beenleigh Marketplace QLD

Beenleigh QLD 4207

Tax Depreciation

T.D$274,903 Over 40 years

$48,065 (Fit-Out)

Learn More

The Saracen’s Head Hotel SA

Adelaide SA 5000

Tax Depreciation

T.D$2,182,498 Over 40 years

$3,575,000

Learn More

Duxton The Brompton Hotel SA

Brompton SA 5007

Tax Depreciation

T.D$2,155,758 Over 40 years

$3,000,000

Learn More

Priceline Pharmacy Traralgon VIC

Traralgon VIC 3844

Tax Depreciation

T.D$766,041 Over 36 years

$2,662,000

Learn More

Bloom Restaurant SA

Thebarton SA 5031

Tax Depreciation

T.D$700,000 Over 40 years

$700,000

Learn More

Tarneit VIC – 4 Beds 2 Bath

Tarneit VIC 3029

Tax Depreciation

T.D$256,866 over 40 years

$261,095

Learn More

North Melbourne VIC – 3 Beds 3 Bath

North Melbourne VIC 3051

Tax Depreciation

T.D$968,000

$154,614 over 30 years

Learn More

Dromana VIC – 3 Beds 1 Bath

Dromana VIC 3936

Tax Depreciation

T.D$96,069 over 40 years

$765,000

Learn More

Clyde VIC – 3 Beds 2 Bath

Clyde VIC 3978

Tax Depreciation

T.D$226,613 over 39 years

$533,000

Learn More

Burwood East VIC – 2 Beds 1 Bath

Burwood East VIC 3151

Tax Depreciation

T.D$248,958 over 40 years

$450,000

Learn More

High Spirits Wholesale Warehouse QLD

Tingalpa QLD 4173

Tax Depreciation

T.D$347,065 Over 40 years

$3,900,000

Learn More

Shopping Plaza QLD

Bray Park QLD 4500

Tax Depreciation

T.D$800,060 Over 40 years

$4,125,000

Learn More

Seafood Restaurant QLD

Cairns North QLD 4870

Tax Depreciation

T.D$73,559 Over 40 years

$295,000

Learn More

Batemans Bay NSW – 3 Beds 2 Bath

Batemans Bay NSW 2536

Tax Depreciation

T.D$217,048 over 32 years

$620,000

Learn More

Schofields NSW – 5 Beds 3 Bath

Schofields NSW 2762

Tax Depreciation

T.D$385,550 over 40 years

$548,000

Learn More

Mortdale NSW – 5 Beds 3 Bath

Mortdale NSW 2223

Tax Depreciation

T.D$1,680,000

$586,063 over 40 years

Learn More

Castle Hill NSW – 3 Beds 2 Bath

Castle Hill NSW 2154

Tax Depreciation

T.D$199,967 over 25 years

$930,000

Learn More

Gosford NSW – 2 Beds 2 Bath

Gosford NSW 2250

Tax Depreciation

T.D$326,630 over 40 years

$415,000

Learn More

Warehouse Factory & Industrial WA

Bibra Lake WA 6163

Tax Depreciation

T.D$38,7410 Over 35 years

$828,000

Learn More

Royal Oak Hotel SA

Penola SA 5277

Tax Depreciation

T.D$1,439,985 Over 40 years

$1,750,000

Learn More

Bushman’s Arms Hotel SA

Naracoorte SA 5271

Tax Depreciation

T.D$2,011,003 Over 40 years

$3,650,000

Learn More

Woolshed Inn Hotel SA

Bordertown SA 5268

Tax Depreciation

T.D$1,939,986 Over 40 years

$2,250,000

Learn More

Harrington Park NSW – 4 Beds 2 Bath

Harrington Park NSW 2567

Tax Depreciation

T.D$1,395,735 over 40 years

$1,800,000

Learn More

Carindale QLD – 5 Beds 3 Bath

Carindale QLD 4152

Tax Depreciation

T.D$110,448 over 32 years

$1,620,000

Learn More

Kewarra Beach QLD – 4 Beds 2 Bath

Kewarra Beach QLD 4879

Tax Depreciation

T.D$185,492 over 40 years

$495,000

Learn More

Toowong QLD – 3 Beds 3 Baths

Toowong, QLD 4066

Tax Depreciation

T.D$750,208 over 40 years

$139,000

Learn More

Old Noarlunga Hotel SA

Old Noarlunga SA 5168

Tax Depreciation

T.D$2,562,348 over 40 years

$11,000,000

Learn More

Commercial Offices QLD

South Brisbane QLD 4101

Tax Depreciation

T.D$594,459 over 40 years

$5,050,000

Learn More

Birkdale QLD – 4 Beds 2 Bath

Birkdale QLD 4159

Tax Depreciation

T.D$313,907 over 39 years

$710,691

Learn More

South Brisbane QLD – 2 Beds 2 Bath

South Brisbane QLD 4101

Tax Depreciation

T.D$372,773 over 40 years

$729,000

Learn More

Annerley QLD – 3 Beds 2 Bath

Annerley QLD 4103

Tax Depreciation

T.D$430,412 over 40 years

$449,296

Learn More

Gisborne VIC – 4 Beds 2 Bath

Gisborne VIC 3437

Tax Depreciation

T.D$330,066 over 40 years

$800,000

Learn More

Nedlands WA – 4 Beds 1 Bath

Nedlands WA 6009

Tax Depreciation

T.D$104,129 over 40 years

$1,840,000

Learn More

Commercial/Industrial Complex QLD

Upper Coomera QLD 4209

Tax Depreciation

T.D$238,251 Over 40 years

$518,000

Learn More

Commercial Centre QLD

Burleigh Waters QLD 4220

Tax Depreciation

T.D$140,579 Over 40 years

$450,000

Learn More

North Lakes Car Wash QLD

North Lakes QLD 4509

Tax Depreciation

T.D$473,503 over 40 years

$$447,994

Learn More

Lodges & Cottages QLD

Tamborine Mountain QLD 4272

Tax Depreciation

T.D$620,935 over 34 years

$2,500,000

Learn More

Sellicks Beach SA – 3 Beds 1 Bath

Sellicks Beach SA 5174

Tax Depreciation

T.D$22,266 over 40 years

$356,800

Learn More

Wakerley QLD – 4 Beds 2 Baths

Wakerley QLD 4154

Tax Depreciation

T.D$252,398 over 38 years

$711,021

Learn More

Acacia Ridge QLD – 3 Beds 1 Bath

Acacia Ridge QLD 4110

Tax Depreciation

T.D$23,920 over 40 years

$352,500

Learn More

Glen Waverley VIC – 2 Beds 1 Bath

Glen Waverley VIC 3150

Tax Depreciation

T.D$307,670 over 40 years

$560,888

Learn More

Langford WA – 2 Beds 1 Bath

Langford WA 6147

Tax Depreciation

T.D$50,510 over 40 years

$255,000

Learn More

Warehouse Factory & Industrial QLD

Molendinar QLD 4214

Tax Depreciation

T.D$1,892,000

$235,080 over 34 years

Learn More

Indoor Playground SA

Sefton Park SA 5083

Tax Depreciation

T.D$1,298,320 over 40 years

$2,033,624

Learn More

Industrial Building WA

Forrestdale WA 6112

Tax Depreciation

T.D$1,298,320 over 40 years

$1,300,000

Learn More

Retail Warehouse QLD

Bundall QLD 4217

Tax Depreciation

T.D$229,418 over 40 years

$3,190,000

Learn More

Carlton VIC – 2 Baths 2 Beds

Carlton VIC 3053

Tax Depreciation

T.D$295,092 over 40 years

$607,500

Learn More

Rouse Hill NSW – 2 Beds 2 Baths

Rouse Hill NSW 2155

Tax Depreciation

T.D$330,794 over 40 years

$645,000

Learn More

Rosehill NSW – 2 Beds 2 Baths

Rosehill NSW 2142

Tax Depreciation

T.D$269,160 over 40 years

$634,000

Learn More

Footscray VIC – 2 Beds 2 Baths

Footscray VIC 3011

Tax Depreciation

T.D$328,174 over 40 years

$535,500

Learn More

North Kellyville NSW – 2 Beds 2 Baths

North Kellyville NSW 2155

Tax Depreciation

T.D$331,607 over 40 years

$649,000

Learn More

Office Warehouse QLD

Mansfield QLD 4122

Tax Depreciation

T.D$89,832 over 31 years

$275,000

Learn More

Tool City QLD

Coopers Plains QLD 4108

Tax Depreciation

T.D$143,963 over 40 years

$639,000

Learn More

Medical Centre VIC

Longwarry VIC 3816

Tax Depreciation

T.D$379,999 over 40 years

$380,000 Construction cost

Learn More

Albion Rooftop Club VIC

South Melbourne VIC 3205

Tax Depreciation

T.D$3,412,497 over 40 years

$5,421,533

Learn More

Padstow NSW – 3 Beds 2 Baths

Padstow NSW 2211

Tax Depreciation

T.D$62,368 over 40 years

$480,000

Learn More

Hope Island QLD – 3 Beds 2 Baths

Hope Island QLD 4212

Tax Depreciation

T.D$59,413 over 21 years

$370,000

Learn More

Pimpama QLD – 3 Beds 2 Baths

Pimpama QLD 4209

Tax Depreciation

T.D$175,235 over 39 years

$491,000

Learn More

West End QLD – 3 Beds 2 Baths

West End QLD 4101

Tax Depreciation

T.D$175,235 over 39 years

$491,000

Learn More

Alderley QLD – 4 Beds 2 Bath

Alderley QLD 4051

Tax Depreciation

T.D$86,076 for 33 years

$1,005,000

Learn More

Lago Vista – 3 Beds 2 Baths

Lago Vista, Dubai

Tax Depreciation

T.D$164,214 over 40 years

$209,138

Learn More

Lakeside – 1 Beds 2 Baths

Lakeside, Dubai

Tax Depreciation

T.D$168,165 over 40 years

$226,506

Learn More

Corby NN18 8PZ – 3 Beds 2 Baths house

Corby NN18 8PZ UK

Tax Depreciation

T.D$232,305 over 40 years

$435,500

Learn More

Old Town Dubai – 1 Bed 2 Baths house

Old Town Dubai UAE

Tax Depreciation

T.D$329,641 over 40 years

$591,666

Learn More

West Moonah TAS – 6 Beds 4 Baths house

West Moonah TAS 7009

Tax Depreciation

T.D$750,000 over 40 years

$750,000

Learn More

Akaroa TAS – 3 Beds 2 Baths house

Akaroa TAS 7216

Tax Depreciation

T.D$239,414 over 40 years

$264,277

Invermay TAS – 2 Beds 1 Baths house

Invermay TAS 7248

Tax Depreciation

T.D$85,733 over 28 years

$287,500

Learn More

Port Sorell TAS – 3 Beds 3 Baths house

Port Sorell TAS 7307

Tax Depreciation

T.D$462,801 over 40 years

$1,150,000

Learn More

Myrtle Bank SA – 4 Beds 3 Baths

Myrtle Bank SA 5064

Tax Depreciation Report

T.D$435,985 over 40 years

$886,000

Learn More

Waterford QLD – 5 Beds 2 Baths

Waterford QLD 4133

Tax Depreciation Report

T.D$200,400 over 40 years

$430,000

Learn More

Macgregor QLD – 5 Beds 2 Baths

Macgregor QLD 4109

Tax Depreciation Report

T.D$179,138 over 40 years

$778,000

Learn More

Smithfield NSW – 3 Beds 1 Bath

Smithfield NSW 2164

Tax Depreciation Report

T.D$59,476 over 40 years

$458,000

Learn More

Retail Shop Kilda VIC

Kilda VIC 3182

Tax Depreciation Schedule

T.D$248,563 over 25 years

$1,130,000

Learn More

Precinct Hotel Cremorne VIC

Cremorne VIC 3121

Tax Depreciation Report

T.D$2,011,782 over 40 years

$2,011,787

Learn More

Office Fitout Pyrmont NSW

Pyrmont NSW 2009

Tax Depreciation Report

T.D$163,344 over 33 years

$397,500

Learn More

Warehouse Henderson WA

Henderson WA 6166

Tax Depreciation Schedule

T.D$1,074,270 over 40 years

$1,850,000

Learn More

Brisbane Valley Tavern and 3 stores Fernvale QLD

Fernvale QLD 4306

Tax Depreciation Report

T.D$1,095,527

$2,275,000

Learn More

Veterinary Clinic Miranda NSW

Miranda NSW 2228

Tax Depreciation Report

T.D$2,342,364 over 40 years

$2,150,000

Learn More

Craigieburn VIC – 4 Beds 2 Baths

Craigieburn VIC 3064

Tax Depreciation Report

T.D$240,811 over 40 years

Construction cost: $272,500

Learn More

Frankston South Vic – 4 Beds 3 Baths

Frankston South, VIC 3199

Tax Depreciation

T.D$451,684 over 40 years

Construction cost: ~$303,505

Learn More

House 4 Bed 3 bath (California, USA)

Manhattan Beach, CA 90266, USA

Tax Depreciation report

T.D$1,183,465 over 40 years

Purchase Price: ~$6,900,000

Learn More

Gumeracha SA – 4 Beds 1 Baths house

Gumeracha SA 5233

Tax Depreciation Report

T.D$84,774 over 40 years

Purchase Price: ~ $360,000

Learn More

Nollamara WA – 3 bed 2 bath house

Nollamara WA 6061

Tax depreciation report

T.D$234,761 over 39 years

Purchase Price: $535,000

Learn More

Youngtown TAS – 2 bed 1 bath house

Youngtown TAS 7249

Tax Depreciation Report

T.D$169,867 over 40 years

Purchase Price: ~$275,000

Learn More

McDonald Restaurant Minyama QLD

Minyama QLD 4575

Tax Depreciation Schedule

T.D$3,410,588 over 40 years

$4,900,000 total for the three site

Learn More

Japanese Restaurant Caloundra QLD

Caloundra QLD 4551

Tax Depreciation Schedule

T.D$246,823 over 40 years

Learn More

Warehouse Rowville VIC

Rowville VIC

Tax Depreciation Report

T.D$375,347 over 40 years

$780,000

Learn More

Emerald Airport Asset Revaluation

Emerald QLD 4720

Asset Revaluation, Tax depreciation

T.D$29.452.575 total depreciation

Learn More

Multi Tenanted Shops Burleigh Waters QLD

Burleigh Heads QLD

Tax Depreciation Report

T.D$363,912 over 40 years

$1,200,000

Learn More

Roll’d Elanora QLD

Elanora QLD

Tax Depreciation Schedule

T.D$172,607 over the 1st financial year

$379,000

Learn More

Factory Warehouse Caboolture QLD

Caboolture QLD

Tax Depreciation Schedule

T.D$45,214 over 40 years

$269,000

Learn More

Ground floor Retail and Cafe Shops Sydney NSW

Sydney NSW 2000

Tax Depreciation report

T.D$805,573 over 40 years

$3,570,000

Learn More

Bake Boss Clarence Gardens SA

Clarence Gardens SA 5039

Tax Depreciation Schedule

T.D$371,700 over 40 years

$1,800,000

Learn More

EzyMart Store Sydney NSW

Sydney NSW 2000

Tax Depreciation Schedule

T.D$279,170 over 40 years

$1,750,000

Learn More

Comfort Inn Coober Pedy Experience

Coober Pedy SA 5723

Task Depreciation Schedule

T.D$375,770

$600,000

Learn More

Office space Sunnybank QLD

Sunnybank QLD 4109

Tax Depreciation Schedule

T.D$147,548 over 40 years

$146,173

Learn More

Supermarket Deception Bay QLD

Deception Bay, Qld 4508

Tax Depreciation Schedule

T.D$1,768,668 over 40 years

$3,500,000

Learn More

Lidcombe NSW – 3 Bed 2 Bath House

Lidcombe NSW 2141

Tax Depreciation Report

T.D$235,5719 for 30 years

$1,150,000

Learn More

Avalon By Mosaic – Arbor 3 bed unit

Maroochydore, QLD 4558

Tax Depreciation Report

T.D$592,206 over 40 years

$1,235,000

Learn More

Avalon By Mosaic – Arbor 2 bed unit

Maroochydore, QLD 4558

Tax Depreciation Report

T.D$391,507 over 40 years

$749,000

Learn More

Double Storey House NSW

Lidcombe, NSW 2141.

Tax Depreciation Report

T.D$235,719 over 40 years

$1,150,000

Mercato on Ferry

Southport QLD 4215

Tax Depreciation Management

T.D$7,447,218 over 40 years

$18,272,008

Learn More

Glenrose Village Shopping Centre

Belrose NSW 2085

Tax Depreciation Management, Tenant Abandonment

T.D$55,321,172 over 40 years

$74,360,811

Learn More

Brisbane Fortitude Valley Metro

Fortitude Valley QLD 4006

Tax Depreciation, Tenant Abandonment

T.D$18,560,005 for over 40 years

$96,000,000

Learn More

Office Fitout – Mackay

Mackay QLD 4740

Tax Depreciation Report

T.D$2,324,626 over 40 years

$3,110,869

Learn More

Flinders Arcade – SA

Victor Harbor SA 5211

Tax Depreciation Report

T.D$64,289 over 29 years.

$165,000

Learn More

Marryatville Hotel

Kensington SA 5068

Depreciation Management

T.D$2,643,428 over 40 years

$3,525,000

Learn More

Flagstaff Hotel

Darlington SA 5047

Tax Depreciation, Asset Register, Depreciation Management

T.D$3,805,594 over 40 years

$7,550,000

Learn More

Mansfield Park Hotel

Mansfield Park SA 5012

Tax Depreciation, Asset Register

T.D$4,979,570 over 40 years

$5,005,080

Learn More

The Seaton Hotel

Seaton SA 5023

Tax Depreciation, Depreciation management

T.D $3,262,738 over 40 years

$6,100,000

Learn More

The Lion Hotel

North Adelaide

Tax Depreciation, Asset Register, Depreciation management

T.D$907,426 over 40 years

$5,500,000

Learn More

Tropical Gateway Motor Inn

Rockhampton

Depreciation management

T.D$701,422 over 40 years

$1,150,000

Learn More

Osborne Park – Warehouse & Office

Osborne Park WA 6017

Tax Depreciation Report

T.D$197,921 over 27 years

$1,220,000

Learn More

Byron Bay Pharmacy

Byron Bay NSW 2481

Tax Depreciation Report

T.D$533,667 over 40 years

$2,325,000

Learn More

Residential House – MacGregor ACT 2615

MacGregor ACT 2615

Tax Depreciation Report

T.D $44,990 over 40 years

$653,000

Curio by Mosaic – Apartment

Upper Mount Gravatt, QLD

Tax Depreciation

T.D$360,135 over 40 years

$490,500

Learn More

Norton Plaza Shopping Centre

Leichhardt, NSW

Tax Depreciation, CAPEX, Fit-out

T.D$44,372,381 over 40 years

$153,200,000

Learn More

Eliza Square Shopping Centre

Mount Eliza, VIC

Tax Depreciation, CAPEX Work

T.D$18,642,093 over 40 years

Learn More

St Helena Mediplex – Medical Centre

St Helena, VIC

Tax Depreciation, Capital Works

T.D$1,614,944

$6,700,000

Learn More

Novotel Southbank

South Bank, Brisbane

Tax Depreciation, CODE Management

T.D$59,152,226 over 40 years

$59,162,191

Learn More

Budds Backpackers

Gold Coast, QLD

Amendments of previous tax returns, Write off expenditure

T.D$1,270,353 over 40 years

Learn More

Large Industrial Unit – Kingsgrove NSW

Kingsgrove, NSW

Tax Depreciation, Acquisition Report

T.D$3,901,786 over 40 years

$37,000,000

Learn More

Hotel – Byron at Byron

Byron Bay, NSW

Tax Depreciation, CAPEX, Asset Register

T.D$29,217,967 over 40 years

$56,522,461

Learn More

Cafes / Food – Zaraffa’s Coffee Shop

Coffs Harbour, NSW

Tax Depreciation, Capital works

T.D$839,096 over 40 years

Learn More

Boutique Hotel – Little Albion Street

Sydney, NSW

Tax Depreciation, CAPEX, Asset Register

T.D$27,750,000

$10,162,104

Learn More

Foster & Partners Architects

Sydney, NSW

Tax Depreciation

T.D$279,170 over 40 years

$1,750,000

Learn More

Flynn Hotel

Cairns , QLD

Tax Depreciation, Asset Registers

T.D$152,769,314 over 40 years

$159,137,014

Learn More

The Bailey – 5 Star Hotel

Cairns , QLD

Tax Depreciation, Asset Register

T.D$97,062,605 over 40 years

$97,550,746

Learn More