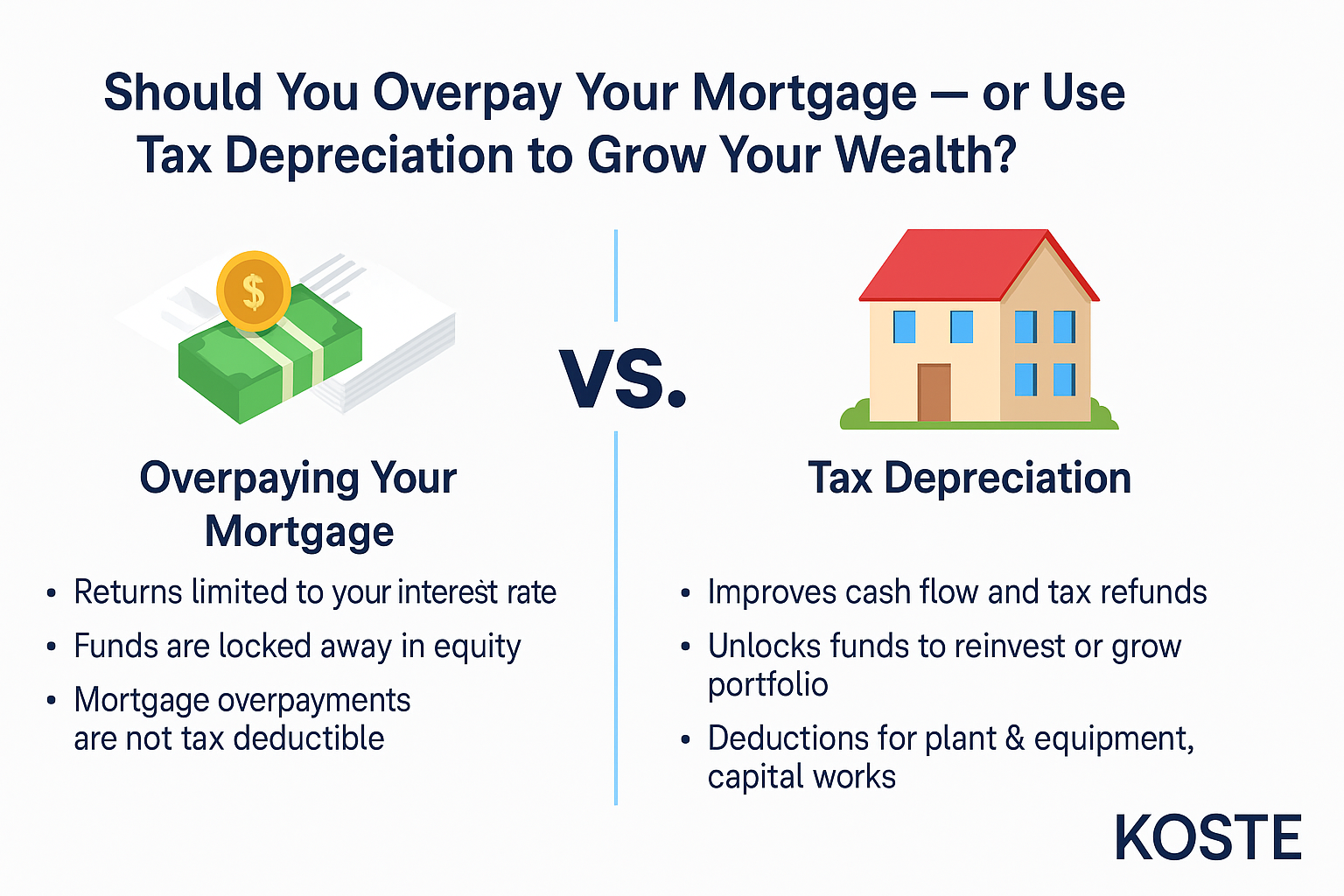

Residential Property Investors lose out up to $17.5 billion annually in unclaimed tax depreciation entitlements.

Australian investors could be claiming an extra $5,000 per property at tax time by following a few simple steps, according to a leading industry expert.

Mark Kilroy, Director of Koste tax depreciation quantity surveying company, says the Australian Tax Office (ATO) is sitting on $17.5 billion in unclaimed tax depreciation entitlements.

“Only 40 percent of investors are taking advantage of property tax depreciation schedules, which average claims of just over $3,000 – thousands lower than the claimable average of $8,000,” says Mr. Kilroy.

“In other words, investors are simply unaware of the benefits and the thousands of dollars they could be claiming.”

“In fact, they’re losing money because they’re probably self-assessing claims, or they’ve employed unqualified persons to carry out the claim.”

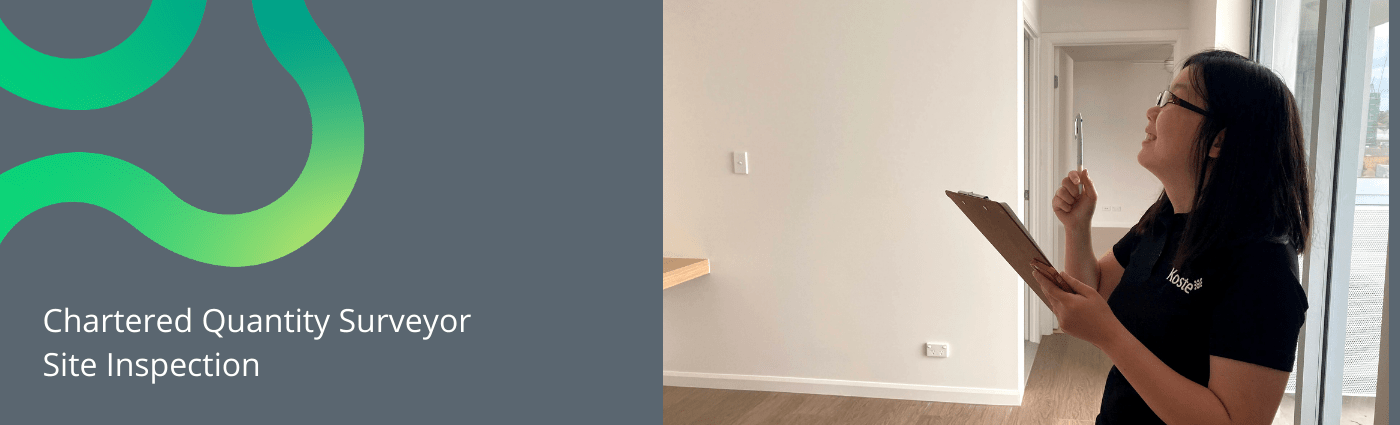

Importance of Site Survey

Mr. Kilroy says quantity surveyors who prepare tax depreciation schedules should actually visit the property or complete a virtual site inspection rather than base the report on a telephone conversation with the client.

“I always recommend using a qualified chareterd quantity surveyor to carry out the site survey and compile the report. This enables them to provide the client with detailed and accurate schedules, which in turn maximizes the claimable amount,” says Mr. Kilroy.

Investor’s depreciation benefits vary depending on the type of building, its age, fit-out, and use. Also, ATO legislation states that the owner of a residential investment property can only claim capital works deductions if construction commenced after 18 July 1985.

However, depreciation of plant and equipment is not limited by age. Instead, it is the condition and the quality of each item which contributes to the depreciable amount.

“Therefore, if your property is eligible for deductions and you’ve never claimed depreciation, you could be entitled to a substantial back claim,” says Mr. Kilroy.

“For example, one of my clients who’d never claimed depreciation in the 1990s built $450,000 property claimed upward of $14,500 in the first year and an average of $8,000 every year thereafter.”

“Koste quantity surveyors identify and value capital and structural works carried outpost original construction. Also, we possess detailed knowledge of the current legislation surrounding plant and equipment to maximize tax depreciation for clients.”

As identified by the ATO from 1 March 2010, all companies preparing tax depreciation schedules must be registered tax agents.

Mr. Kilroy says all Koste surveyors are registered tax agents and specialize in tax depreciation schedules for both residential and commercial clients Australia wide.

Click here for the full property deduction checklist.

We offer 3 residential tax depreciation packages to select from, one for every budget. First, add your preferred residential depreciation package to your cart. Secondly, check out the order with your details through secured payment. Last, once payment is confirmed, we will start preparing your report.

Order your preferred residential depreciation package online. Koste has prepared a convenient online portal to handle your application and get your tax depreciation report back to you quickly and efficiently to suit all budgets.

Related Tags: Depreciation on Residential Building, Residential Property Depreciation

Silver

$395+gst

One-off payment

- 40x Year Summary

- Diminishing & Prime Cost Methods

- Low Cost & Value Pooling

- Previous Owner Works

- Common Areas

- Quick & Easy Form To Complete

- Quantity Surveyor Prepared Report

Gold

$495+gst

One-off payment

Silver Package Plus:

- Site Survey (Virtual or Physical)

- Capital Loss Deductions (Div 40)

- Complimentary Consultation

- Photographic Evidence

- Property Research

- Director Sign-off

- Maximum Deductions

Platinum

$595+gst

One-off payment

Gold Package Plus:

- Unlimited Report Updates

- Asset Scrapping / Write offs

- Furniture

- RP Data – Property Report*

- RP Data – Rental Appraisal Report*

- RP Data – Suburb Report*

- *Subject to area availability on RP Data

About Koste

Koste Tax depreciation quantity surveyors specialize in the preparation of inspected tax depreciation schedules for residential, commercial, and industrial clients nationally. Their experienced quantity surveyors and tax registered agents have a wealth of experience. Also, they have advised some of Australia’s leading property investment companies and superannuation funds companies.

For more information visit www.koste.com.au or call 1300 669 400

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.