Start Maximising Your Tax Savings

Are you missing out on $1000’s of dollars on your tax return?

If you are a property investor, you need to keep reading!

Up to 80% of investors fail to maximise their investments’ tax benefits by using property depreciation. They simply do not understand precisely what may be identified as a legitimate tax deduction on their properties, meaning they are missing out on claiming thousands of dollars in tax savings! Apart from claiming your mortgage and insurance for the investment property, depreciation is one of the most significant claims for your income tax deduction.

Don’t stress about the finer details of tax depreciation, this is where we come in, and we want to help you maximise your tax savings!

Koste is a leading provider in Tax Depreciation Schedules. Our team of Quantity Surveyors are specifically trained and recognised by the Australian Tax Office as specialists in recording all depreciable components of your investment property.

Our years of experience have allowed us to establish market-leading technology to carry out Tax Depreciation Schedules, providing you value for money with detailed and accurate reports.

To start maximising your tax savings download our Guide to Maximising your Tax Returns now.

Mark Kilroy MRICS MAIQS Bsc (Hons) Quantity Surveying

Founder & CEO

Related Tags: Residential Property Depreciation, Tax Depreciation Australia

Free Product Guide eBook

Other people viewing…

Koste Awarded Highly Commended – Quantity Surveying Team of the Year

RICS Awards 2025, Melbourne We are proud to announce that Koste Chartered Quantity Surveyors has been recognised as Highly Commended – Quantity Surveying Team of the Year at the RICS Australia Awards 2025, held in Melbourne. This recognition represents one of the...

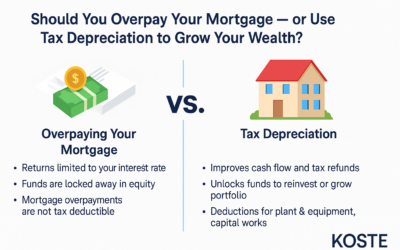

🏠 Should You Overpay Your Mortgage — or Use Tax Depreciation to Grow Your Wealth?

Here’s a bold truth: Overpaying your mortgage won’t make you wealthy — but reinvesting tax savings might. With Australia’s property market seeing significant capital growth in recent years, the smartest investors aren’t pouring every spare dollar into debt reduction....

How Mum-and-Dad Investors Can Help Solve Australia’s Housing Crisis

Australia is facing a housing shortage of 1.5 million homes, and the rising costs of construction and labour, alongside regulatory delays, are stalling new developments. However, mum-and-dad investors—who own 72% of Australia’s investment properties—could be the key...

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.