Unlocking Hidden Wealth: How Much Are You Overpaying in Tax?

What is Tax Depreciation?

Tax depreciation is a deduction available to property investors, allowing them to claim the wear and tear on their investment properties. This deduction is crucial for reducing taxable income and ultimately increasing your return on investment.

The Scope of the Issue

In Australia, there are approximately 3.25 million investment properties owned by around 2.24 million taxpayers. Despite this, a significant majority are not taking full advantage of tax depreciation deductions.

The Financial Impact

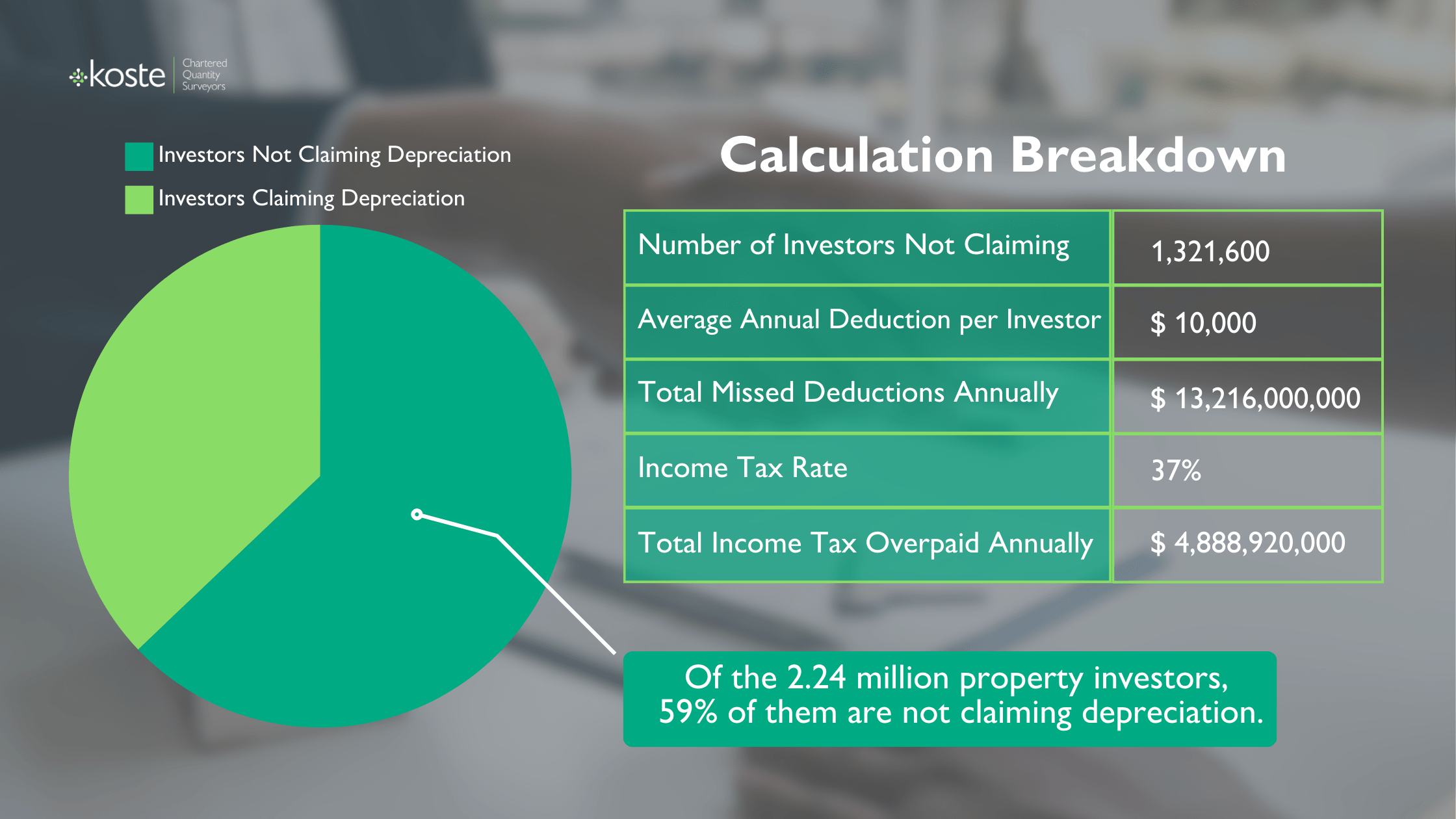

To put this into perspective, the average tax depreciation claim is about $10,000 annually. If 59% of property investors are missing out, we can calculate the total value of missed deductions and the consequent overpayment of income tax.

Calculation Breakdown

The Consequences

Every year, property investors are collectively overpaying $4.89 billion in income tax simply because they are not claiming their tax depreciation deductions. This is a substantial amount that could otherwise be reinvested into properties, improving cash flow, and enhancing investment portfolios.

The Hidden Potential for Commercial Properties

It’s worth noting that the figures provided by the ATO only cover residential properties. For commercial property owners, the potential tax savings are significantly higher. Commercial properties often qualify for more substantial deductions due to their higher value and more extensive use of plant and equipment.

Why You Need to Act Now

The Australian Taxation Office (ATO) is increasingly focusing on property investors, ensuring compliance and maximising revenue collection. If you do not claim the deductions you are entitled to, the government will use your overpaid tax on other projects. Are they best placed to spend your money, or are you?

By saving on tax, you as a property investor can:

- Reinvest in Your Properties: Enhance the quality of your rental properties, attracting better tenants and increasing rental income.

- Invest in New Projects: Expand your portfolio and take advantage of new investment opportunities.

- Help with the Housing Crisis: By reinvesting in your properties and expanding your portfolio, you contribute to alleviating the housing crisis by providing more rental homes.

Conclusion

The message is clear: Claiming tax depreciation deductions is a vital step for any property investor looking to maximise their returns. At Koste Chartered Quantity Surveyors, we specialise in helping investors navigate the complexities of tax depreciation, ensuring they claim every dollar they’re entitled to. Don’t let the taxman keep more than his fair share. Reach out to us today and unlock the hidden wealth in your property investments.

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.