Build-to-Rent: A New Era for Residential Property Investors

The Australian government recognises the potential of build-to-rent projects in addressing the housing crisis and promoting long-term rental solutions. The recent budget announcement has introduced favourable tax breaks for property investors, revolutionising the rental market and offering fresh opportunities for maximising returns.

The Rise of Build-to-Rent

Build-to-rent is a rapidly emerging concept in Australia that aims to revolutionise the rental market. In this innovative approach, purpose-built developments are constructed specifically for long-term rental purposes, providing tenants with exceptional living experiences and meeting the increasing demand for high-quality rental accommodations. Unlike traditional residential properties, build-to-rent projects prioritise tenant satisfaction by offering modern design, a range of amenities, and professional management services. This focus on creating a superior rental experience sets build-to-rent apart, providing tenants with a lifestyle that rivals homeownership. Through these purpose-built developments, property investors have the opportunity to tap into a thriving rental market and capitalise on the rising demand for long-term rental options. By understanding the unique needs and preferences of renters, build-to-rent in Australia is poised to reshape the rental landscape and provide lucrative opportunities for investors.

Advantages for Property Investors

Investing in build-to-rent brings several advantages for property investors:

- Higher Occupancy Rates and Lower Tenant Turnover: : Purpose-built properties are designed to cater to the needs and preferences of tenants, offering desirable features and amenities. As a result, build-to-rent properties tend to have higher occupancy rates compared to traditional residential properties. The emphasis on providing an exceptional living experience reduces tenant turnover, ensuring a more stable and consistent rental income stream for investors.

- Strong Rental Yields: Build-to-rent developments focus on long-term rentals and provide additional amenities that attract tenants willing to pay a premium. This, in turn, contributes to strong rental yields for investors. The combination of higher rental income and lower vacancies enhances the overall financial performance of build-to-rent investments, offering attractive returns.

- Tenant Stability and Diverse Renter Base: By prioritising tenant satisfaction and creating a superior rental experience, build-to-rent properties foster tenant stability. The amenities, services, and well-managed communities contribute to long-term tenant retention. Additionally, the appeal of purpose-built rental properties attracts a diverse range of renters, including young professionals, families, and downsizers, reducing the risk of prolonged vacancies and ensuring a steady income stream.

- Diversification Opportunities: Build-to-rent investments provide opportunities for diversification in a property portfolio. Investors can allocate their capital across multiple build-to-rent projects, spreading the risk and minimizing exposure to market fluctuations. This diversification strategy helps protect against localized market downturns and provides the potential for long-term capital appreciation as the popularity of build-to-rent continues to grow.

Ownership Landscape: Institutional vs. Individual Investors

It is important to note that many build-to-rent properties are currently owned by institutional investors such as Lendlease and Mirvac. The accessibility of these opportunities to individual investors remains unclear at this stage. While the recent budget changes provide tax breaks and depreciation benefits, it is uncertain whether these advantages will primarily benefit institutional investors or if mum and dad investors will have equal access.

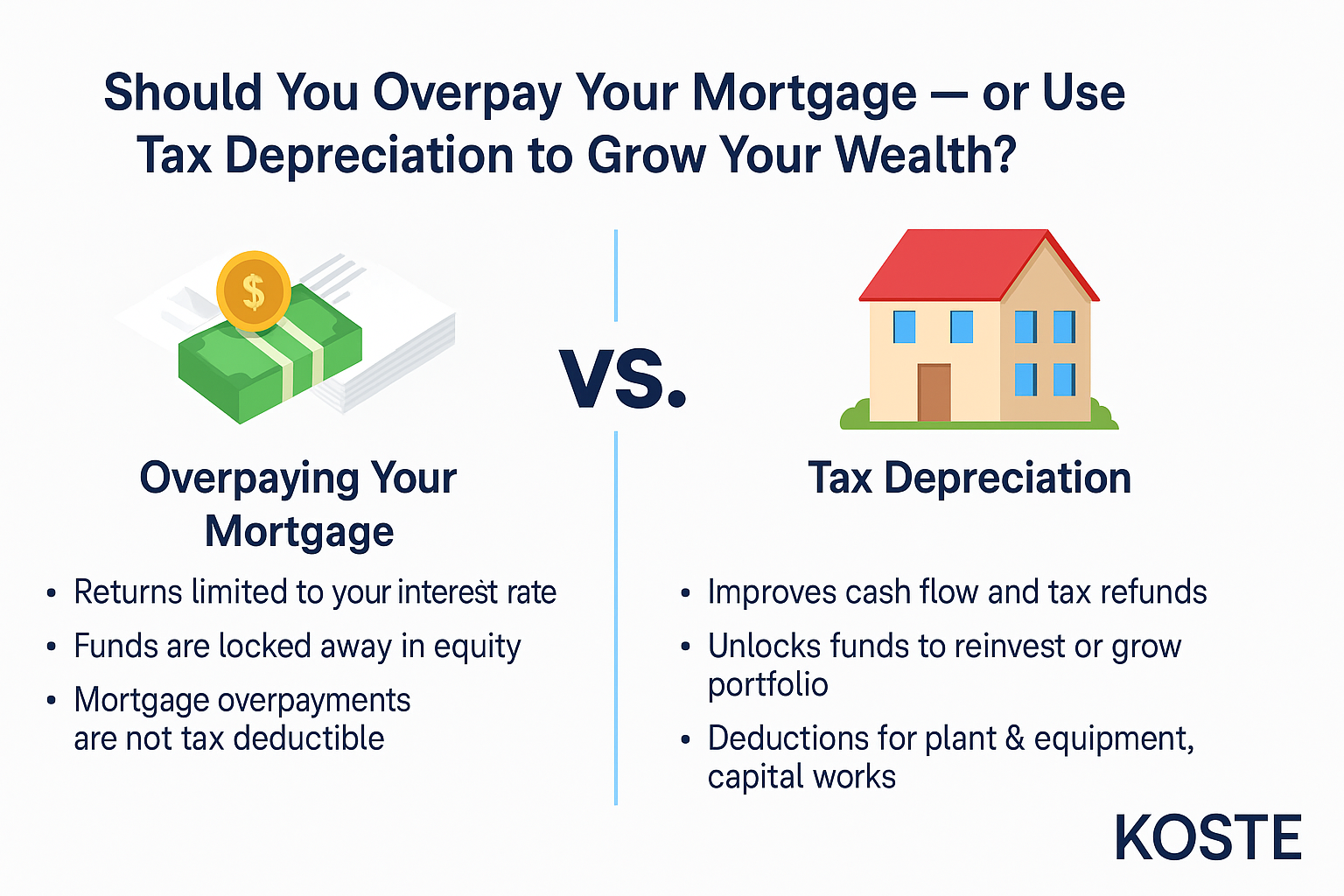

Depreciation Benefits and Tax Breaks

The recent budget announcement includes significant changes to depreciation rates, particularly for Div. 43 Capital Works. This component plays a crucial role in tax depreciation claims for property investors. The depreciation rate for Div. 43 Capital Works will increase from 2.5% to 4.00% per year for build-to-rent projects commenced after May 9, 2023. This enhancement presents a significant opportunity for property investors to maximise their tax deductions and improve their overall returns.

Learning from the UK Experience

The UK has been at the forefront of the “build-to-rent” movement for years. Corporate landlords have been acquiring blocks of flats in city centres, reshaping the rental landscape. While the Australian market may differ, the rise of build-to-rent in the UK serves as a testament to its potential as a game-changer for property investors.

Conclusion

Build-to-rent presents a new era for property investors in Australia, offering the potential for higher rental yields, tenant stability, and long-term capital appreciation. The recent budget changes, including tax breaks and increased depreciation rates, provide added incentives for investors. However, the accessibility of these opportunities to individual investors and the impact of institutional ownership remain uncertain. As the rental market evolves, it is evident that build-to-rent will continue to shape the industry, providing fresh opportunities and redefining the rental experience.

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.