by Mark Kilroy | Jun 13, 2025 | Residential Tax Deprecation

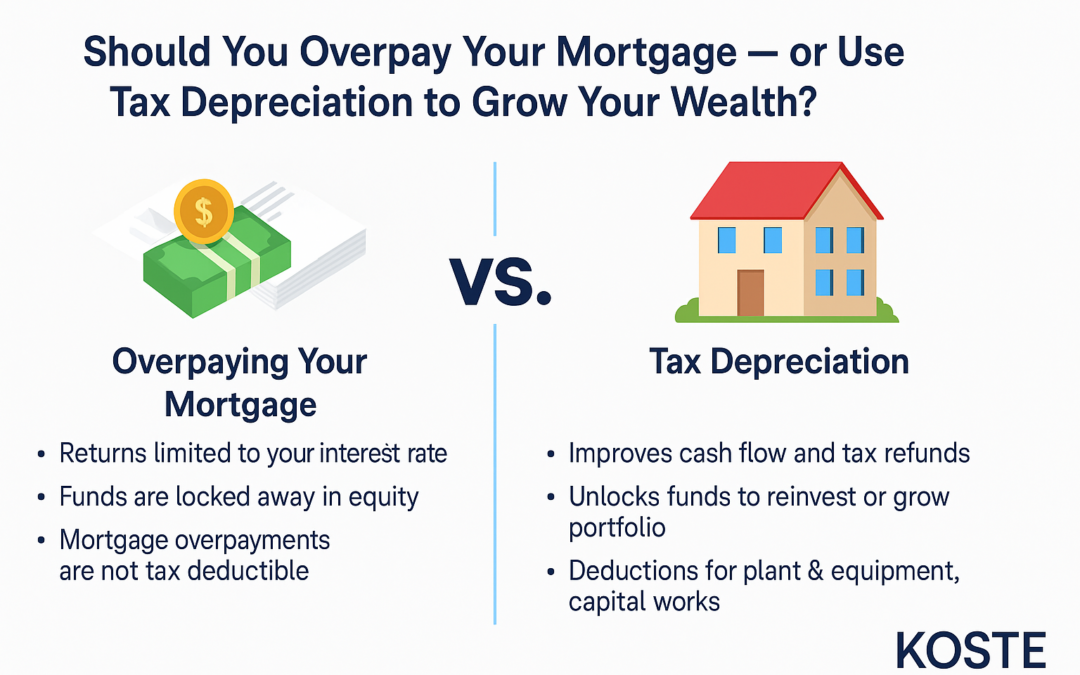

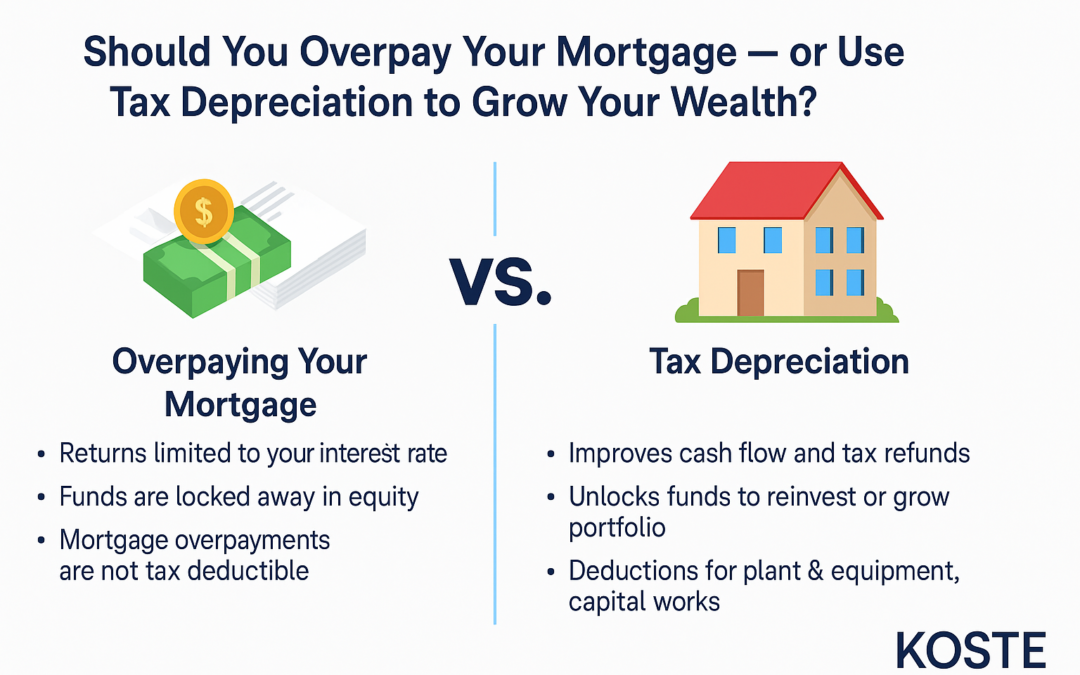

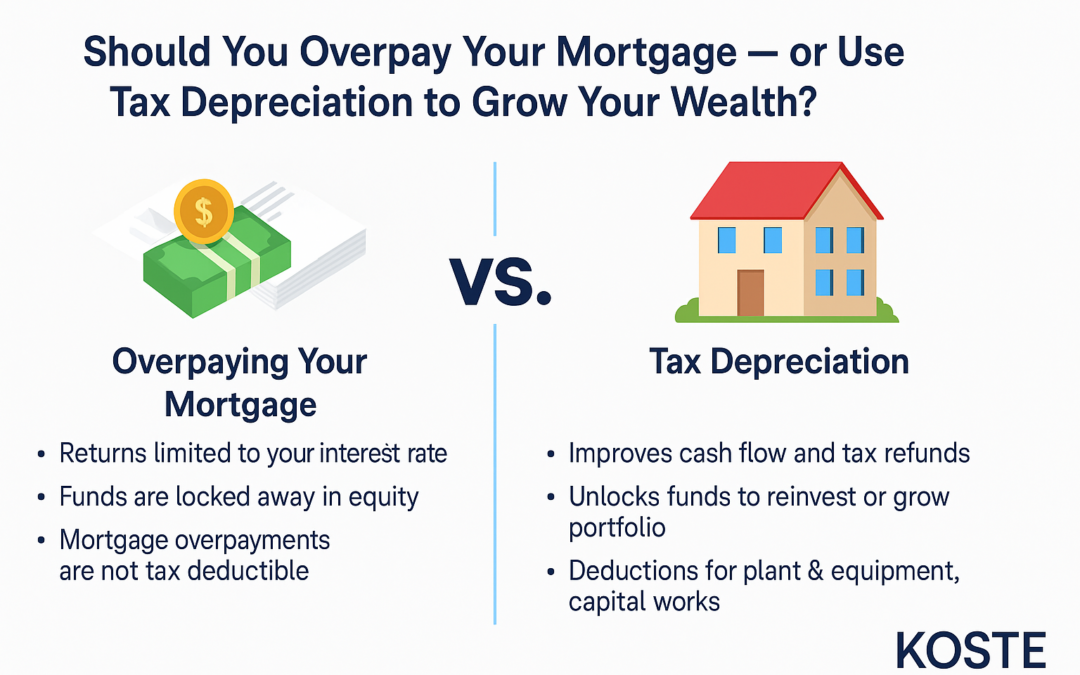

Here’s a bold truth: Overpaying your mortgage won’t make you wealthy — but reinvesting tax savings might. With Australia’s property market seeing significant capital growth in recent years, the smartest investors aren’t pouring every spare dollar into debt reduction....

by Mark Kilroy | Oct 16, 2024 | Residential Tax Deprecation

Australia is facing a housing shortage of 1.5 million homes, and the rising costs of construction and labour, alongside regulatory delays, are stalling new developments. However, mum-and-dad investors—who own 72% of Australia’s investment properties—could be the key...

by srijana | Sep 17, 2024 | Capital Gains & Asset Disposal, Tax Depreciation

Reduce Your Capital Gains Tax (CGT): Essential Tips for Property Investors For property investors, Capital Gains Tax (CGT) can significantly affect your profit when you sell. However, with careful planning, there are effective ways to reduce the amount you owe. In...

by srijana | Sep 13, 2024 | Tax Depreciation

At Koste Chartered Quantity Surveyors, we specialise in helping a wide range of clients, from large corporations to individual investors, navigate the complex world of tax depreciation. When it comes to properties damaged by fire, floods, or other events, insurance...

Recent Comments