May 9th, 2017 Changes for Residential Properties

It has been a number of years since the government announced in the 2017/18 budget measures to assist with the problems of housing affordability; however, investors are still unaware of these changes. These measures affected the tax legislation in relation to investment properties, which limited plant and equipment (Div 40).

These changes were implemented to stop entities from claiming inflated deductions relating to their rental properties by ‘refreshing’ the values of previously used depreciating assets in residential rental properties. Furthermore, the legislation changes on second-hand property now defer the depreciation benefits for the decline in value of Division 40 plants until the sale of the property.

As a result, the amounts that would previously have been claimed under Division 40 plant are now utilised at disposal and form the basis of a CGT event. Any capital loss will be offset against the capital gain incurred on the sale of land and buildings, so there is no difference in the total tax payable over the 5-year period.

The only changes are in claiming the tax benefit and the impact on cash flow. Although your second-hand property may not be eligible to claim Division 40 deductions immediately, any deferred depreciation benefit should still be calculated and reported as a “capital loss” when you sell the property.

A depreciation schedule is essential to any property investor, regardless of the property’s age. Therefore, your depreciation will include a capital loss deduction on a second-hand property, which will be needed to calculate the written-down value needed at property disposal.

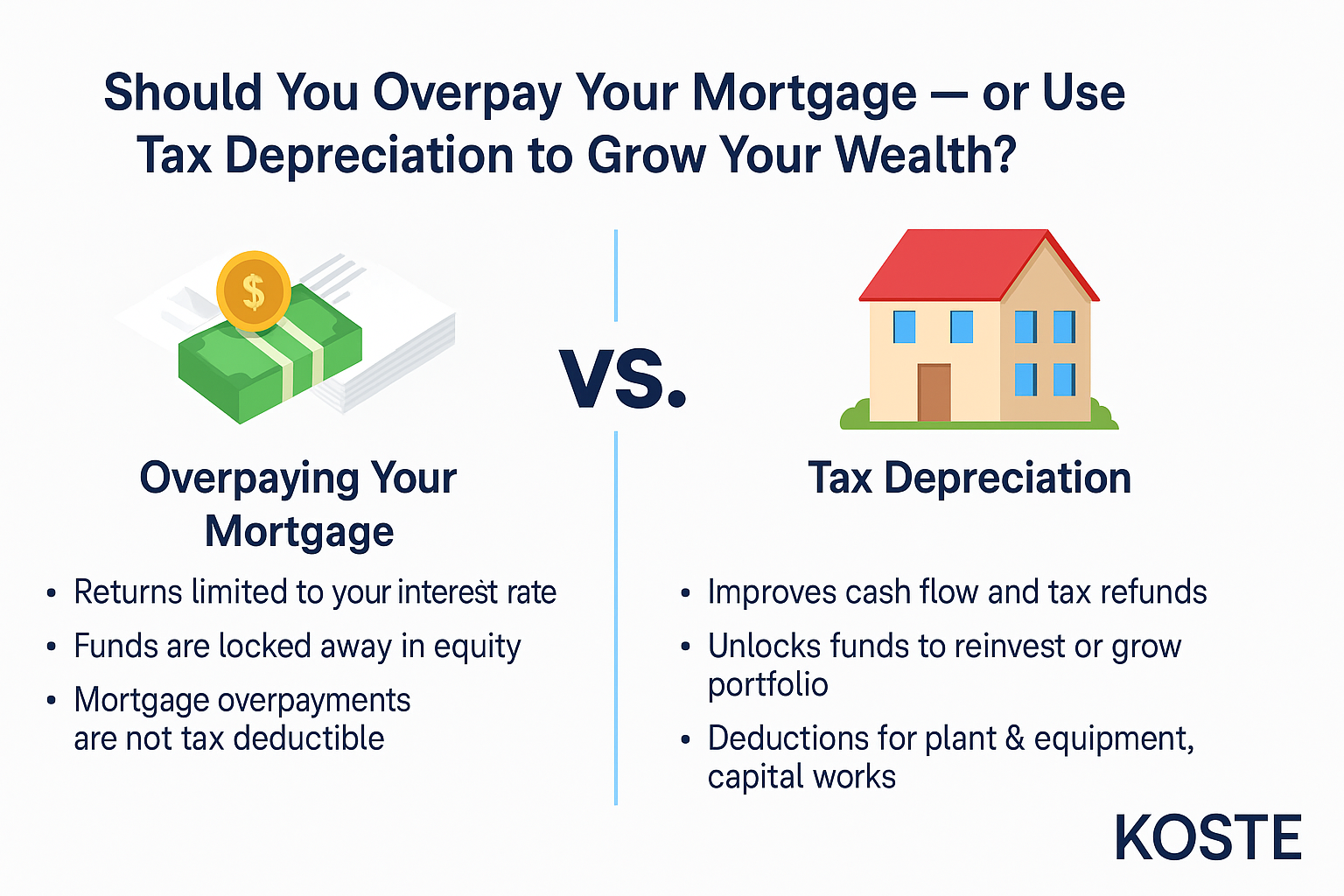

Maximise property tax depreciation

Get a Free Quote today

Koste are the leading providers of commercial Tax Depreciation reports. Whether you are a tenant completing a fit-out or landlord recently purchasing a property we can help.