by Mark Kilroy | Oct 28, 2020 | Tax Depreciation

What to look for in a Tax Depreciation Report When you or your client purchases or constructs a property, you may be advised to obtain a Tax Depreciation Report to help you save income tax. Although you may have some knowledge why you have to get a report, you may not...

by [email protected] | Oct 8, 2020 | Industry & Policy Updates, Koste News & Case Studies

The government announced in the 2017/18 budget measures to assist with the problem of housing affordability. These measures affected the tax legislation in relation to investment properties, which limited plant and equipment. These changes were implemented to stop...

by Mark Kilroy | Oct 6, 2020 | Industry & Policy Updates, Koste News & Case Studies, Residential Tax Deprecation

Australian investors could be claiming an extra $5,000 per property at tax time by following a few simple steps, according to a leading industry expert. Mark Kilroy, Director of Koste tax depreciation quantity surveying company, says the Australian Tax Office (ATO) is...

by Mark Kilroy | Oct 1, 2020 | Koste News & Case Studies, Tax Depreciation

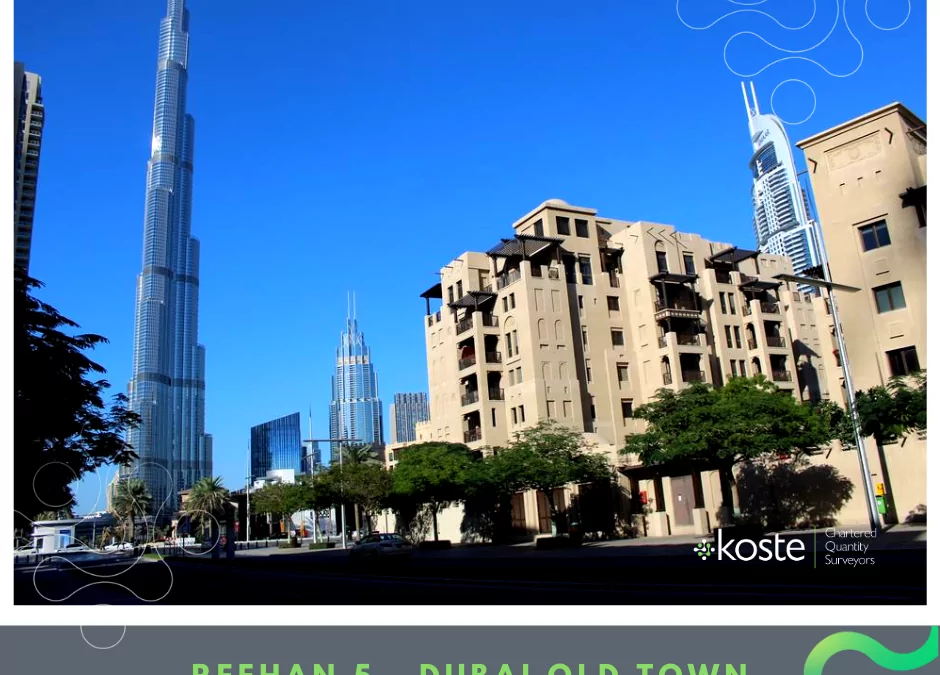

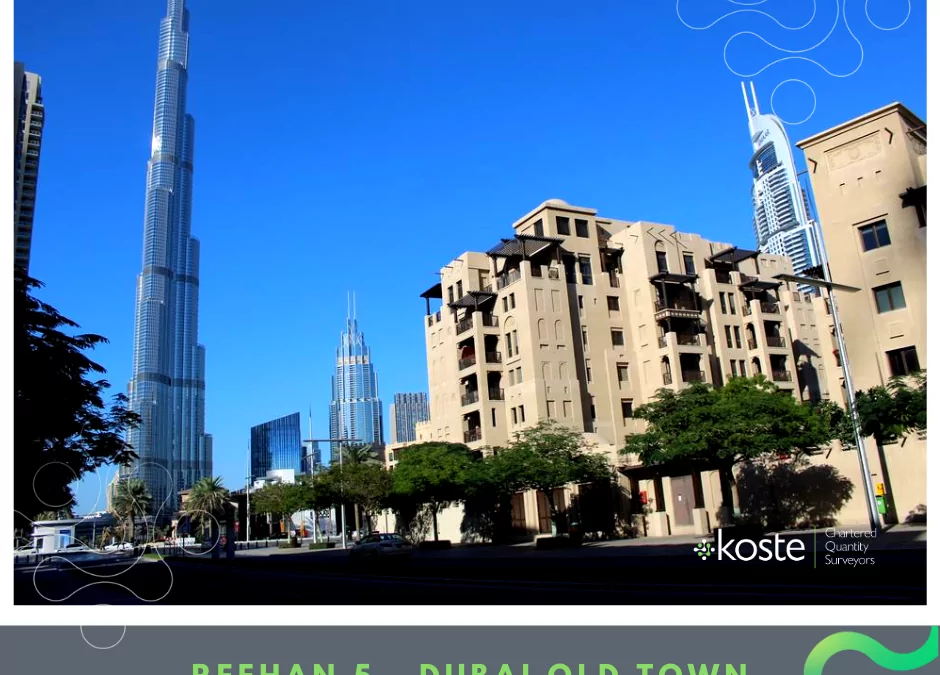

Did you know you are eligible to claim Tax Depreciation entitlements if you own a property overseas as an Australian Resident? Our Directors have experience in completing Tax Depreciation Schedules on many properties throughout cities of the world including Dubai,...