Exciting news! Claim Tax Depreciation entitlements for your overseas properties.

Did you know you are eligible to claim Tax Depreciation entitlements if you own a property overseas as an Australian Resident? Our Directors have experience in completing Tax Depreciation Schedules on many properties throughout cities of the world including Dubai, London, Singapore, New York, and Auckland. Our team uses local construction costs to calculate build costs, utilizing the current exchange rates between the property location currency and Australia (AUD).

Overseas Residential Property

In 2020, we have completed a number of tax depreciation reports for Australian clients with overseas properties. Here are some of the jobs that we have recently completed.

United Kingdom, London

| Property Type: | Apartment Unit |

| Purchase Price: | $605,853 |

| Building Age: | 7 years |

| Depreciation Entitlement: | $233,000 Total for 40 years |

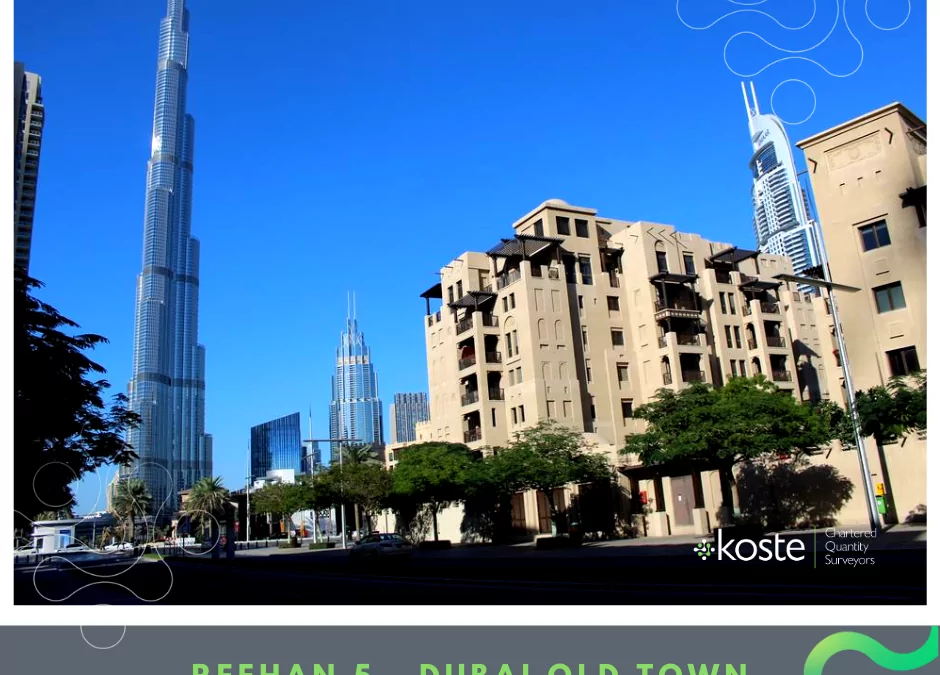

Old Town, Dubai

| Property Type: | 1 Bed Apartment |

| Purchase Price: | $329,000 |

| Depreciation Entitlement: | $71,000 in the first 5 years |

If you are looking for tax deductions from your overseas investment properties, we are here to assist. With over 20 years experience in Quantity Surveying and property investments, our experienced Directors and Quantity Surveyors are able to complete your comprehensive tax depreciation schedules for your tax entitlement.

Related Tags: Construction Cost Guide Australia