by Mark Kilroy | Mar 24, 2021 | Koste News & Case Studies, Tax Depreciation

As a property investor you already know the tax benefits of property investing. But are you giving yourself the best opportunity to lower your taxable income by maximising your tax deductions? Understand your tax entitlements for a positive cash flow by using our list...

by Mark Kilroy | Feb 23, 2021 | Koste News & Case Studies, Tax Depreciation

Are you missing out on $1000’s of dollars on your tax return? If you are a property investor, you need to keep reading! Up to 80% of investors fail to maximise their investments’ tax benefits by using property depreciation. They simply do not understand...

by Mark Kilroy | Oct 28, 2020 | Tax Depreciation

What to look for in a Tax Depreciation Report When you or your client purchases or constructs a property, you may be advised to obtain a Tax Depreciation Report to help you save income tax. Although you may have some knowledge why you have to get a report, you may not...

by Mark Kilroy | Oct 1, 2020 | Koste News & Case Studies, Tax Depreciation

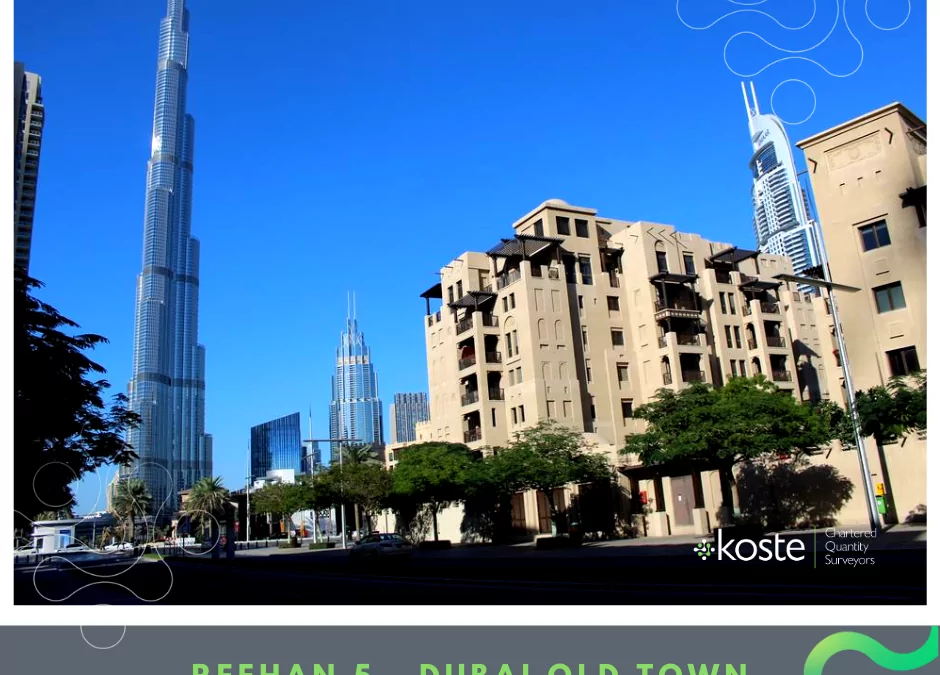

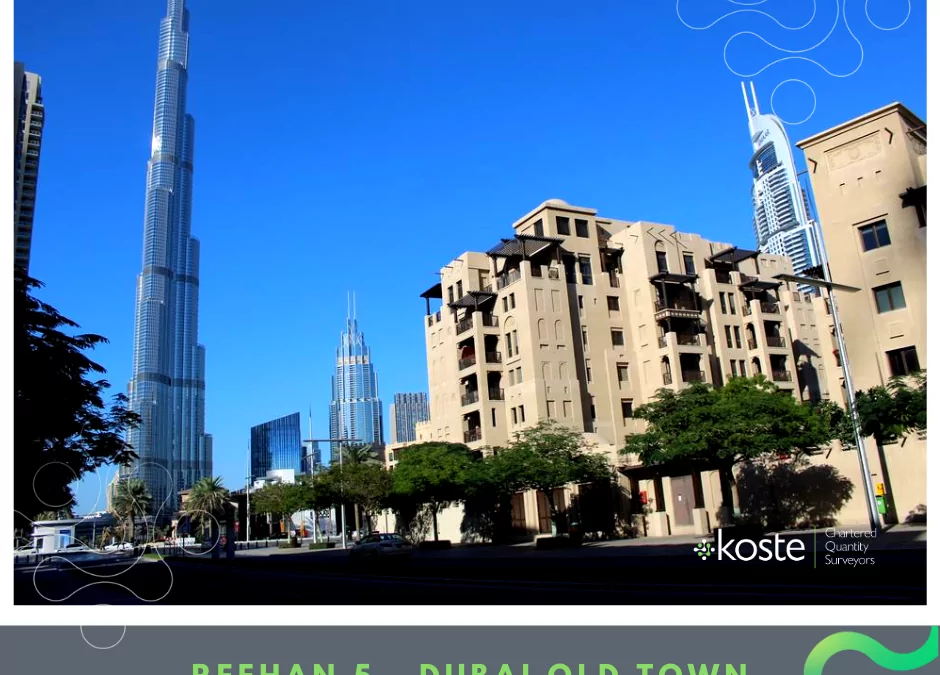

Did you know you are eligible to claim Tax Depreciation entitlements if you own a property overseas as an Australian Resident? Our Directors have experience in completing Tax Depreciation Schedules on many properties throughout cities of the world including Dubai,...

by Mark Kilroy | Sep 7, 2020 | Koste News & Case Studies, Tax Depreciation

During this tax season, many property investors now have very tight budgets. They often choose the lowest price companies, from just $190 to complete their Tax Depreciation Schedule. As a national provider that has prepared Tax Depreciation Schedules for nearly 20...

by Mark Kilroy | Aug 19, 2020 | Tax Depreciation

Introducing vKoste Since March 2020, the Koste team has been implementing the first virtual Tax Depreciation site inspection service to assist our Quantity Surveyors in the current environment of COVID. With the restriction, we have launched vKoste as our new solution...