Choosing a Qualified Quantity Surveyor for Tax Depreciation

There has been much confusion over the years especially for clients looking to engage a Qualified Quantity Surveyor, which is why I have decided to write this short guide to help clients make informed decisions.

Koste Chartered Quantity Surveyors are dedicated experts in Tax Depreciation for both Residential and Commercial clients across Australia. Our team combines the expertise of a Quantity Surveyor with specialized knowledge in Taxation to achieve optimal results for our clients.

Our team receives thousands of inquiries annually, addressing both technical and administrative queries from investors and business owners. Recently, there has been a rise in questions regarding the significance of a company being a member of the AIQS and RICS. However, many individuals are unaware of the meaning and significance of these professional organizations within the industry.

Why is a Quantity Surveyor needed to prepare a Tax Depreciation Schedule?

A Quantity Surveyor is needed to prepare a Tax Depreciation Schedule because they have the specialized knowledge and training in cost management and construction economics to accurately identify and document all the construction and fit-out costs associated with a property. They can identify and include all eligible items for tax depreciation in the schedule and ensure that the schedule is accurate and compliant with tax laws and regulations.

What is also important to not is Tax Ruling 97/25 which is a ruling issued by the Australian Taxation Office (ATO) that clarifies the qualifications and experience required for an individual or organization to prepare a tax depreciation schedule for a property.

The ruling states that a Quantity Surveyor, who is a Member of the Australian Institute of Quantity Surveyors (AIQS), or a Member of the Royal Institute of Chartered Surveyors (RICS) can complete tax depreciation reports for a property. The ruling also states that a Quantity Surveyor must have the necessary technical knowledge and experience to identify and document all of the construction and fit-out costs associated with a property, including items that are eligible for tax depreciation. Additionally, the ruling states that a Quantity Surveyor must have a good understanding of tax laws and regulations and must ensure that the tax depreciation schedule is accurate and compliant with these laws and regulations.

Is there a difference with professional membership level?

As with any professional organization, both the AIQS and the RICS have different levels of membership. These levels range from student and graduate memberships for those new to the industry, to Fellow grade for highly skilled and experienced members of the organization. It is important to examine the different membership levels offered by each professional body.

What is the AIQS (Australian Institute of Quantity Surveyors?

The Australian Institute of Quantity Surveyors (AIQS) is a professional organization in Australia that represents and supports Quantity Surveyors. The organization is dedicated to promoting and advancing the practice of Quantity Surveying in Australia. It provides a range of services to its members, including professional development, networking opportunities, and advocacy on behalf of the profession. AIQS also sets standards of professionalism and ethics for Quantity Surveyors, and provides a range of resources and information to support the practice of Quantity Surveying. Membership to the AIQS is open to professionals in the field of Quantity Surveying, including Quantity Surveyors, cost managers, and other construction professionals.

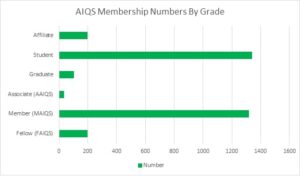

As of today, the Australian Institute of Quantity Surveyors (AIQS) has 3236 registered members in Australia. The statistics below show the breakdown of members by grade of membership, starting with Affiliate Members (who are not currently working in Quantity Surveying) and ending with Fellow Grade (senior members of the AIQS).

Based on the membership grade, businesses that do not have 50% of Quantity Surveyors who are not at Associate, Member of Fellow Grade are not eligible to use the AIQS Logo. Affiliate Only members of the AIQS are not recognized as professionals who are working in Quantity Surveying.

Please note: As of 30th June 2022 Affiliate Grade members will also not be able to use the AIQS (Affil.) post-nominals. Affiliate membership is only available to those who are not working in construction cost management/quantity surveying. Details of the AIQS Member policy can be found by clicking the following:

What is the RICS (Royal Institute of Chartered Surveyors)?

The Royal Institution of Chartered Surveyors (RICS) is a globally recognized professional organization that sets standards and oversees the work of surveyors and other property professionals worldwide. Quantity Surveyors who specialize in tax depreciation are members of RICS and are responsible for giving expert advice on the measurement, management, and valuation of construction costs, as well as creating schedules of tax depreciation for buildings and other structures. They collaborate with architects, engineers, and other specialists to ensure that the construction project is completed on schedule, within budget, and to the highest standards of quality. Members who attain the highest level of qualifications will be further regulated by RICS for additional client peace of mind.

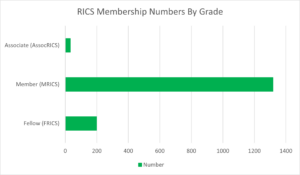

Currently, the RICS has 2,298 registered members in Australia. Among them, approximately 40% are Quantity Surveyors and less than 10% are registered tax agents who are qualified to prepare tax depreciation schedules. The following statistics provide a breakdown of members by their grade of membership, ranging from Associate Members to Fellow Grade.

Statistics: RICS.org

Conclusion

In summary, it is crucial for clients to choose a Quantity Surveyor who has the appropriate membership grade and qualifications to create their tax depreciation schedule. These professionals have the expertise to correctly determine the depreciation of the property in question. Professional bodies such as the AIQS and RICS set standards and regulate the activities of Quantity Surveyors worldwide, ensuring that their members are qualified, competent, and abide by a strict code of conduct. Quantity Surveyors who are full voting Members or above have shown their knowledge and skills through rigorous evaluations and ongoing professional development, and are held accountable for their professional conduct. It is important to note that being a registered Tax Agent, which is authorized by the government to give tax advice, does not represent a higher level of professional certification.

Therefore, clients should select a Quantity Surveyor or company like Koste that can demonstrate full membership of a professional body such as the AIQS and RICS, and can be confident that they possess the necessary experience and knowledge to provide accurate and dependable advice on tax depreciation. It’s also important to remember that Affiliate Members do not practice Quantity Surveying.