Our Residential

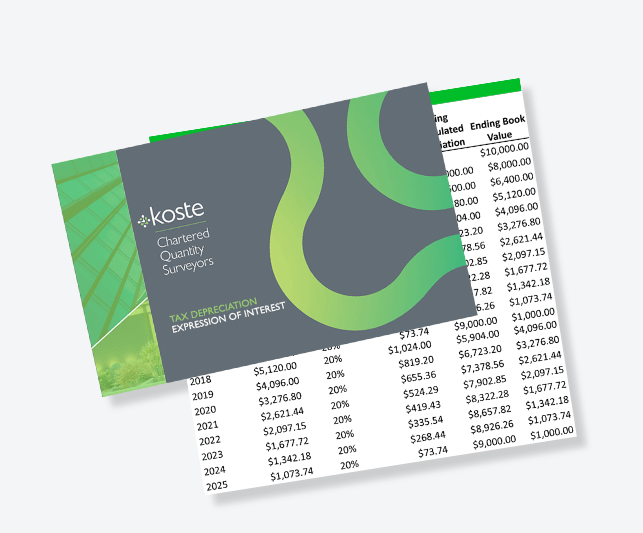

Depreciation Report

Koste offers Mosaic Property clients a discounted depreciation report for only $295+GST (usually $695+GST). Simply click ‘order now’ below to purchase the report for your property.

What is included in our packages?

– 40-year depreciation schedule

– Diminishing & Prime Cost methods

– Low Value Pooling & Writeoffs

– Common Areas – Previous Owner & Renovation Works

– Get Report 1-3 Business Days

– QS Review / Approval

– Web Portal Access (Free Updates)

– Split Ownership Report

Mosaic Property Report

$295+GST

QS Review

One-off payment

Free Tax Depreciation

Estimates

Koste specializes in providing Mosaic clients with detailed tax depreciation schedules, utilizing the latest tax depreciation legislation to ensure maximum returns for their clients. With their market-leading product and methodology, Koste delivers comprehensive and accurate schedules at unbeatable prices.

By staying up-to-date with the latest tax depreciation laws, Koste ensures that clients benefit from the most advantageous depreciation strategies. Their expertise in this field allows them to provide detailed estimates for Mosaic Property Group clients, covering essential components such as total tax depreciation for five years, income tax savings, plants and equipment, and capital works.

Koste’s commitment to delivering precise and comprehensive tax depreciation schedules sets them apart in the industry. By leveraging their expertise and knowledge, they help Mosaic clients optimize their returns and navigate the complexities of tax depreciation.

Our packages include:

Detailed Report

Maximum Deductions

Capital Works

Shared Assets

Free Updates

As a valued client, we will update your schedule Free of charge whilst you are the owner of the property.

Site Inspection

A qualified surveyor will carry out your site inspections both virtually and physically. Also, if no site survey is required, you will be offered a discounted fee.

Furniture

For furnished property, we will include the assets in your report at no extra cost.

Scrapping

If you own a property with common areas, you will be entitled to claim a percentage of these assets based on your lot entitlement.

Keep up with the latest

Sign up for our newsletters, upcoming webinars, events or blog articles.

"*" indicates required fields