by Mark Kilroy | Oct 14, 2025 | Commercial & Business Tax Depreciation, Industry & Policy Updates, Residential Tax Deprecation

RICS Awards 2025, Melbourne We are proud to announce that Koste Chartered Quantity Surveyors has been recognised as Highly Commended – Quantity Surveying Team of the Year at the RICS Australia Awards 2025, held in Melbourne. This recognition represents one of the...

by Mark Kilroy | Jun 13, 2025 | Residential Tax Deprecation

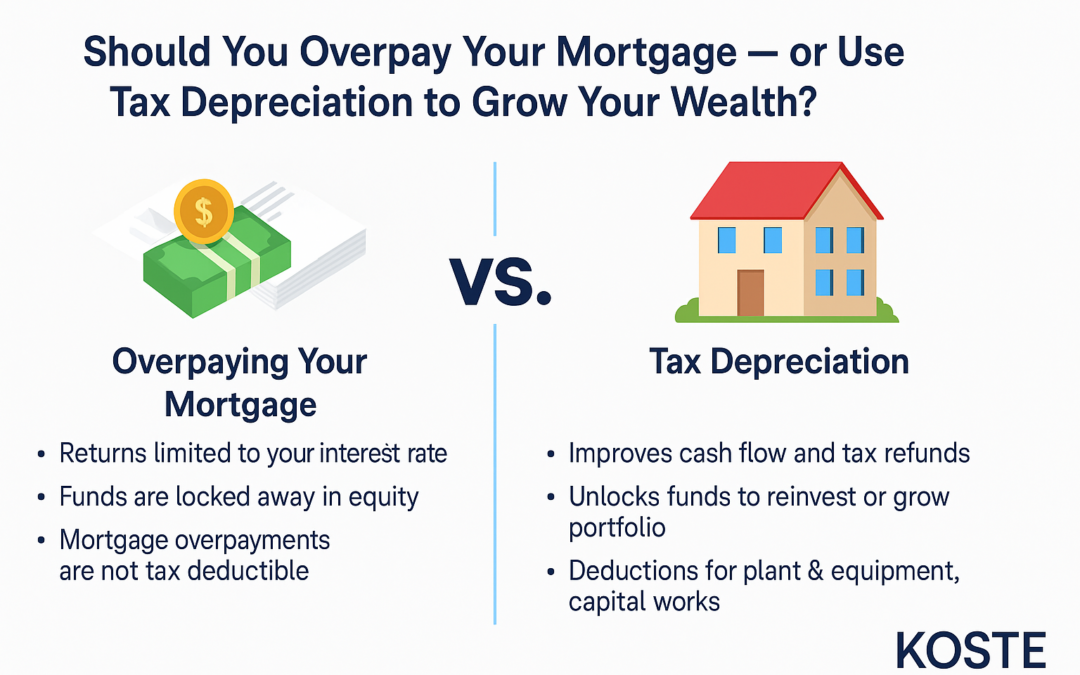

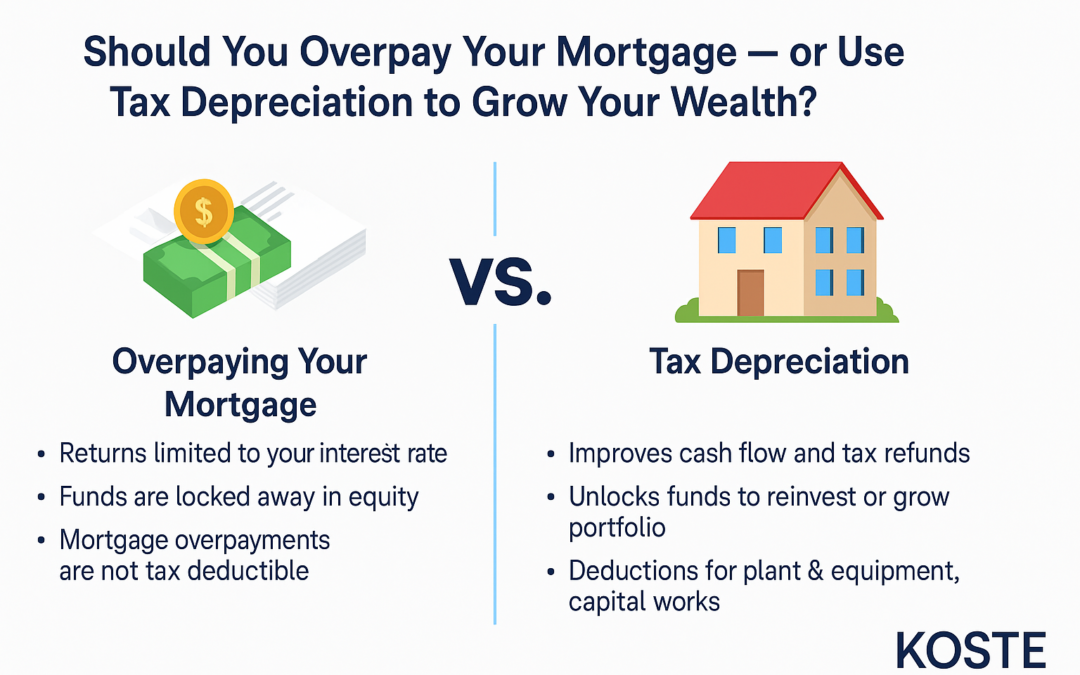

Here’s a bold truth: Overpaying your mortgage won’t make you wealthy — but reinvesting tax savings might. With Australia’s property market seeing significant capital growth in recent years, the smartest investors aren’t pouring every spare dollar into debt reduction....

by Mark Kilroy | Oct 16, 2024 | Residential Tax Deprecation

Australia is facing a housing shortage of 1.5 million homes, and the rising costs of construction and labour, alongside regulatory delays, are stalling new developments. However, mum-and-dad investors—who own 72% of Australia’s investment properties—could be the key...

by May | Apr 19, 2024 | Residential Tax Deprecation

In the fast-paced world of property investment, there’s a game-changing strategy that’s often overlooked: TAX DEPRECIATION. While the glitterati bask in the tax-free haven of Monaco, the average Australian property investor has a powerful tool right at...

by May | Jun 13, 2023 | Koste News & Case Studies, Residential Tax Deprecation

Explanation of Depreciation for Tax Purposes Consider buying a brand-new automobile. Due to normal wear and tear, the automobile’s value progressively depreciates. The same remains true for a number of asset and construction materials of your investment...

by srijana | Jun 7, 2023 | Koste News & Case Studies, Residential Tax Deprecation

Depreciation is an important concept in accounting that measures the decrease in the value of an asset over time. When it comes to residential properties, depreciation reports are essential for determining the value of a property and assessing its overall condition....